Is Caterpillar Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Caterpillar fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Caterpillar's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Caterpillar's key statistics:

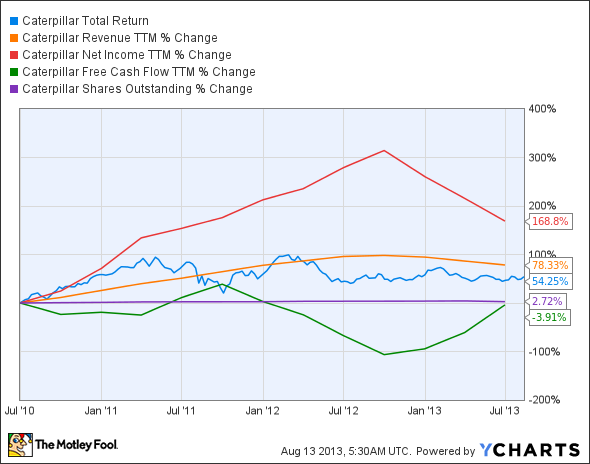

CAT Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 78.3% | Pass |

Improving profit margin | 50.7% | Pass |

Free cash flow growth > Net income growth | (3.9%) vs. 168.8% | Fail |

Improving EPS | 158.8% | Pass |

Stock growth (+ 15%) < EPS growth | 54.3% vs. 158.8% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

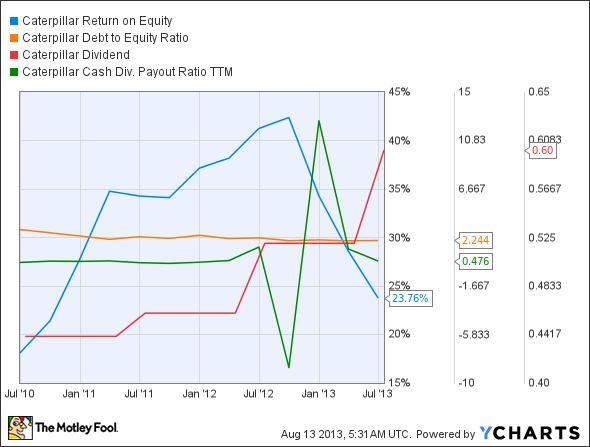

CAT Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 31.3% | Pass |

Declining debt to equity | (29.3%) | Pass |

Dividend growth > 25% | 36.4% | Pass |

Free cash flow payout ratio < 50% | 47.6% | Pass |

Source: YCharts. * Period begins at end of Q2 2010.

How we got here, and where we're going

Caterpillar puts together an extremely strong performance, earning eight out of nine possible passing grades. It missed out on a perfect score because of falling free cash flow, which has diverged from its net income over the past three years, and which threatens to undermine the health of its dividend payments. Will Caterpillar to able to move past this problem? Let's dig a little deeper to find out.

Last month, Caterpillar disappointed investors by missing on both the top and bottom lines in its latest earnings report. The company's revenue fell 16% year over year, and double-digit declines are never a good sign for a company widely viewed as a construction and industrial bellwether. Caterpillar's resource industries, primarily devoted to mining, suffered a terrible 34% drop year over year as the global mining industry continues to suffer through brutal price declines across a range of earth-bound commodities.

Despite this weakness, Caterpillar recently launched an accelerated $1 billion capital-return plan that should boost shareholder confidence in the company's core business activities. With signs of relative strength in the United States offering some breathing room, Caterpillar has decided to keep an eye on its international markets, especially its mining and construction segment, which now comprises 70% of its total revenues. Fool contributor Dan Caplinger notes that Caterpillar has managed to maintain $20.4 billion in order backlog in spite of its present weakness.

Putting the pieces together

Today, Caterpillar has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

With the U.S. relying on the rest of the world for such a large percentage of our goods, many investors are ready for the end of the "made in China" era. Well, it may be here. Read all about the biggest industry disrupters since the personal computer in 3 Stocks to Own for the New Industrial Revolution. Just click here to learn more.

The article Is Caterpillar Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.