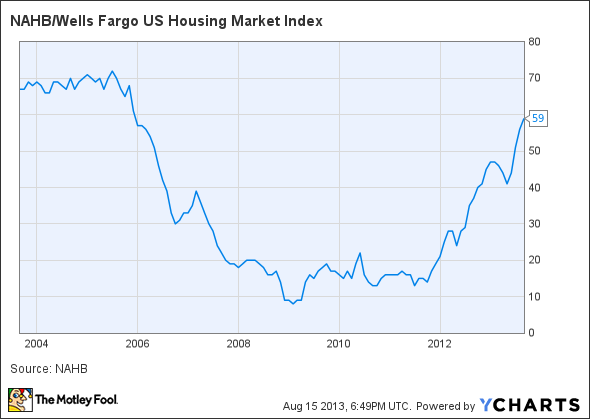

Homebuilder Confidence Hits Highest Level Since 2005

Homebuilder confidence is still headed up, according to August's National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index report released today.

After clocking in at a revised 56 points for July, August's 59 reading marks the fourth straight month of gains, and is the highest rating the index has recorded in nearly eight years. Analysts were pleasantly surprised by the news, having expected more of the same for August.

Any number over 50 indicates that more builders view sales conditions as good than poor, a point reached for the first time in June since April 2006. The survey looks at builder confidence in newly built single-family homes.

NAHB/Wells Fargo US Housing Market Index data by YCharts.

"Builders are seeing more motivated buyers walk through their doors than they have in quite some time," said NAHB Chairman Rick Judson in a statement today. "What's more, firming home prices and thinning inventories of homes for sale are contributing to an increased sense of urgency among those who are in the market."

Digging deeper into components, current sales conditions improved three points to 62, prospective buyer traffic remained unchanged at 45, and future sales expectations for the next six months added on one point to reach 68.

Although this month's report is loaded with positive points, NAHB Chief Economist David Crowe noted that supply concerns remain:

Builder confidence continues to strengthen along with rising demand for a limited supply of new and existing homes in most local markets. However, this positive momentum is being slowed by the ongoing headwinds of tight credit and low supplies of finished lots and labor.

The article Homebuilder Confidence Hits Highest Level Since 2005 originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter @TMFJLo and on Motley Fool CAPS @TMFJLo.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.