How R&D and Dividends Change the Game for Intel Stock

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

Intel shares just passed the 4% dividend yield level -- again. The stock has been hit-and-miss in 2013, surging and falling like a high-octane roller coaster. Dividend payouts have remained stable, so the yield curve became a mirror image of the price chart. Right now, Intel's stock is falling again, which explains why effective yields are on the rise.

Either way, the dividend checks have grown like ragweeds over the past decade, and Intel's yields are extremely high in a historical perspective.

INTC Dividend Yield data by YCharts.

Not only that, but the company's board is getting a little overdue for another dividend policy boost. Payouts have grown an average of 12.8% over the last five years. Intel already offers the third most generous yield among the 30 Dow Jones Industrial Average members; the next boost is likely to push Intel into second place.

Intel's share prices are suffering from the widely held idea that its products are becoming irrelevant. The onslaught of mobile computing solutions -- tablets, smartphones -- is powered by competing microchip designs, leaving Intel on the sidelines during a massive market revolution.

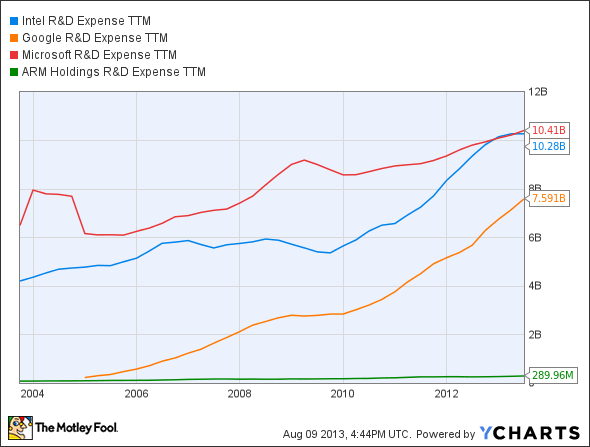

But then you're forgetting that Intel is getting its mobile house in order, and that the company can out-research pretty much anybody in Silicon Valley and beyond. Consider this telling chart:

INTC R&D Expense TTM data by YCharts.

Google is one of the most innovative companies in the world. Big G spends more time shutting down failed experiments than many others do on their core projects -- and then Google starts another batch of experiments. It's no wonder that the company's R&D expenses are skyrocketing.

But Intel's R&D budget is not just larger than Google's -- it can also nearly match Mountain View's budget increases, blow by blow. That's no mean feat for a supposedly mature giant like Intel.

Microsoft has pretty much always spent more on research than its hardware companion. But while Intel hit the gas pedal in recent years, Microsoft chose to respond to the changing marketplace by holding back on research. Intel is now spending just as much as Microsoft on paving the way toward future success, and that's new.

And mobile expert ARM Holdings , which provided the blueprints for the current generation of smartphone and tablet chips, is just a blip on the radar. You might think that the company would sink the windfall from its mobile success into heavy research on the next Next Big Thing, but the numbers tell a somewhat different story. ARM's R&D budgets have increased by 84% over the last five years. Intel largely kept pace with a 75% boost.

Economies of scale really do matter. Come back in another five years and see what's new. You'll find Intel firmly established in the now-mature mobile market while ARM fights to find another winning lottery ticket. Intel's earnings will bounce back with mobile support, enabling even more dividend increases.

Intel is too big, too rich, and too forward-thinking to be forgotten. This is why I own Intel stock myself. There's also a bullish CAPScall to go along with the real-money position. The rich dividend is delicious icing on the undervalued cake.

Want to get in on the smartphone phenomenon? Intel is starting to look like a serious play on this megatrend while it's still developing. But you might want to cut even closer to the core of the mobile market. Truth be told, one company sits at the crossroads of smartphone technology as we know it. It's not your typical household name, either. In fact, you've probably never even heard of it! But it stands to reap massive profits NO MATTER WHO ultimately wins the smartphone war. To find out what it is, click here to access the "One Stock You Must Buy Before the iPhone-Android War Escalates Any Further..."

The article How R&D and Dividends Change the Game for Intel Stock originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Intel and Google, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of Google, Microsoft, and Intel. Motley Fool newsletter services have recommended buying shares of Google. Motley Fool newsletter services have recommended creating a bull call spread position in Intel. Motley Fool newsletter services have recommended creating a bull call spread position in Microsoft. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.