Can Natural Gas and Special Tax Status Keep These Dividend Stocks Soaring?

Spectra Energy and Spectra Energy Partners reported earnings this week, tag-teaming an asset rearrangement that Mr. Market expects to bring plenty of profits for both companies. With earnings data in and details announced, here's the latest on your dividend stocks.

Number crunching

On the top line, Spectra's operating revenue clocked in $1.220 billion, 9.7% above Q2 2012, but slightly less than analysts' $1.264 billion projections.

The same story held true on the bottom line. Spectra reported adjusted EPS of $0.30, $0.03 below last year's second quarter and $0.02 below analysts' estimates.

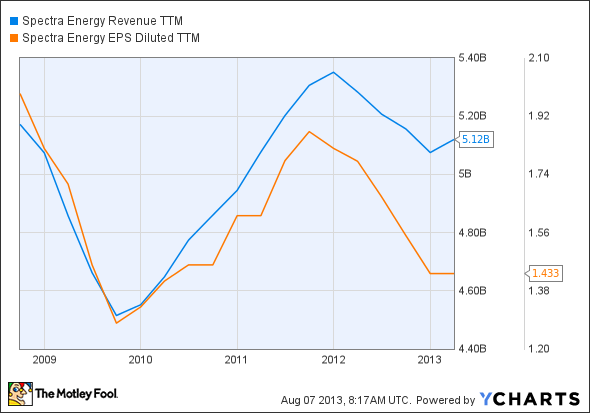

For a peck of perspective, here's how Spectra's done over the last five years. While sales have ended up more or less where they were in August 2008, adjusted EPS has dropped off 30%, mostly over the last couple years:

SE Revenue TTM data by YCharts

Putting numbers in place

Although analysts were watching the numbers to see how much earnings Spectra pocketed this past quarter, the real news came from Spectra's continued asset "drop-down" to Spectra Energy Partners. The former will hand off all remaining U.S. transmission and storage assets, as well as all remaining liquid assets, to the latter, paving the way for Partners to take advantage of a lucrative master limited partnership (MLP) tax status.

While that's good news for Spectra Energy Partners, it also paves the way for Spectra Energy to focus on lucrative transmission projects. Just two weeks ago, the company announced that it would be teaming up with NextEra Energy to build Florida's third major natural gas pipeline. The project is priced at $3 billion, but will vastly improve the state's gas infrastructure as regional demand continues to head higher.

Source: Spectra Q2 2013 Earnings

Spectra's also got its eye on new transmission in the Marcellus Shale region. Chesepeake Energy marketing is working through the contracting for Spectra on a $500 million, 73-mile pipeline that will link the reserves to the Gulf Coast.

Source: Spectra Q2 2013 Earnings

At the same time, the utility's keeping some gas close to home with an $850 million expansion to its current Northeast regional connection. With 15-year contracts in the bag from Northeast Utilities, National Grid , and UIL Holdings, the renovation is well deserved.

Source: Spectra Q2 2013 Earnings

Can the Spectras keep soaring?

Spectra and Partners have made remarkable gains in the last year. Both stocks soared on the news of Spectra's asset dropdown, although Spectra Energy Partners ultimately pocketed more of the market-moving action.

With the big news over, the real question is whether Spectra's transmission deals and Spectra Energy Partners' operations and tax status will live up to expectations. Both stocks' P/E ratios are about 70% higher than their peers, but stable earnings are a lucrative lure for income investors. The utility's dividend yield stands at 3.45%, while the MLP's clocks in at 4.75%.

At current prices, I think Partners offers investors a long-term dividend churner for those wanting consistent distributions without worrying as much about short-term share price rises and dips. Although Spectra Energy's got big transmission plans of its own, its valuation puts it out of my price range for the time being.

If you're considering either of these two companies for your portfolio, it's absolutely necessary that you diversify your profits beyond energy-based dividend stocks. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article Can Natural Gas and Special Tax Status Keep These Dividend Stocks Soaring? originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends National Grid plc (ADR) and Spectra Energy. The Motley Fool has the following options: long January 2014 $30 calls on Chesapeake Energy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.