AT&T Leads the Dow's Slide

Although we don't believe in timing the market or panicking over market movements, we do like to keep an eye on big changes -- just in case they're material to our investing thesis.

U.S. stock markets have declined slightly today on very little economic news. Investors are still concerned about tapering from the Federal Reserve in coming months and, after a run-up nearly all year, it's pretty normal for stocks to take a bit of a breather. The Dow Jones Industrial Average is down 0.46% late in the trading day and the S&P 500 has fallen 0.32%.

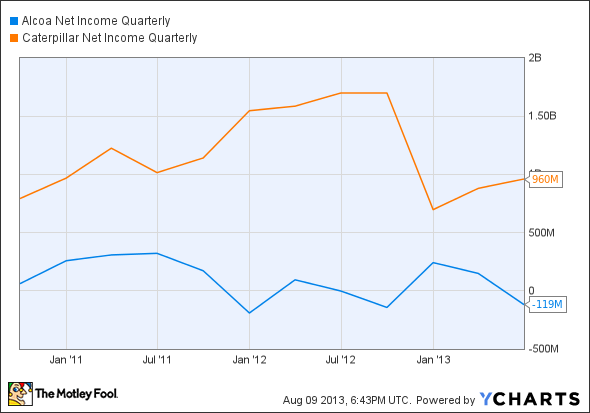

The up and down trading days of Alcoa and Caterpillar continued today with the stocks climbing 3.2% and 0.8%, respectively. Investors are buying both stocks because of a report showing that China's industrial production rose 9.7% in July from a year ago. This follows positive data about exports yesterday and gives investors hope that China's economy won't slow as many have predicted. For the long term, we should be more concerned about the profits of both companies than about one economic report and the overall lower trends of the past year.

AA Net Income Quarterly data by YCharts

We should also keep in mind that China can be notoriously uneven and inaccurate with economic reports, so buying on a single data point isn't a good move. Instead, look for progress on an earnings front and take heed of management's comments in coming quarters because that's more important for the stock long term.

AT&T continues to decline today, falling 1.3%. There's a lot of concern that T-Mobile will take share after gaining 1.1 million customers in the most recent quarter. The quarter may show that AT&T and Verizon Wireless need to be more flexible in pricing and contracts or risk losing customers to their smaller rivals. With the stock trading at 13 times forward estimates and paying a 5% dividend yield, I don't think there's any long-term concern for AT&T and dips like this are great buying opportunities for investors.

One of the reasons AT&T is down is that T-Mobile got the iPhone in the second quarter and had a rush of new customers buying the hot product. But the iPhone isn't as dominant as it once was and only one company will benefit no matter which smartphone consumers are buying today. To find out what it is, click here to access the "One Stock You Must Buy Before the iPhone-Android War Escalates Any Further..."

The article AT&T Leads the Dow's Slide originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.