I'm Buying This High-Flying Stock Now

Every month, I select one or more stocks that I'll be buying in real life for my Roth IRA. I've been doing this for over two years, and -- not including dividends -- these picks have returned 27%, which is beating the S&P 500 by almost 8 percentage points.

This month, I'm buying two stocks that have gone on great runs lately. Instead of backing out because I've anchored on the previous price of these stocks, I'm going to be putting my money behind their business momentum and innovation.

The first of these two stocks is Medidata Solutions .

What the company does

The process of bringing new medicines and medical devices to market can be a long and arduous one. There are research costs, randomized clinical trials, and many levels of Food and Drug Administration approvals that need to be navigated. Carried out over years, with millions of different products, this process can cost medical companies billions of dollars.

That's where Medidata comes in. The company's core product -- Medidata Rave -- is a cloud-based, software-as-a-service offering that helps to streamline the approval process and cut down on costs.

Rave, and its ancillary applications, specifically focuses on designing randomized studies, assisting trial protocols, optimizing resource allocation, capturing data electronically, and managing clinical trial data.

Can history repeat itself?

If you think about it, the progression of the medical approval process to a cloud-based solution makes sense.

It was 1999 when salesforce.com was founded, and now the company offers cloud-based solutions to businesses that focus on sales, service, and marketing strategies. Since the company went public, its shares have risen almost 1,000% and is now worth more than $25 billion.

CRM Total Return Price data by YCharts.

If, at any point in time, an investor would have been scared of strong price appreciation, he or she could have missed out on huge gains. Even a purchase made right before the Great Recession would have returned 150%, outpacing the S&P 500 by more than 100 percentage points. And since mid-2011, shares of salesforce have traded hands at more than 40 times earnings.

There are two things to learn from this. The first is that being a first-mover in the cloud while providing industry-specific software can be a runway for enormous growth potential. The second is that when dealing with fast-growers like this, it is sometimes more useful to evaluate how expensive a stock is by its market cap, rather than its price-to-earnings ratio.

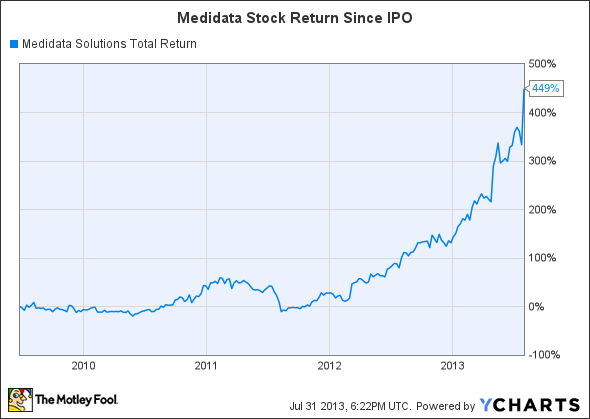

While Medidata has also seen strong appreciation since its IPO -- and it trades for about 72 times non-GAAP earnings -- I think the company's $2.3 billion valuation shows there's still room for growth.

MDSO Total Return Price data by YCharts.

Why I'm buying

There are two key variables that, if they continue, will lead to brighter days for Medidata shareholders. The first is continued migration of pharmaceutical and other medical companies to Medidata's Rave platform. Medidata already counts 20 of the top 25 global pharmaceutical companies among its clients, with Johnson & Johnson, Roche, and AstraZeneca being the biggest three.

But a look at the full client list gives you the feeling that other companies are starting to see the value in using Medidata's cloud software.

Source: SEC filings.

The second variable that I'll keep my eye on is the number of clients using more than one Medidata product. If this number grows, it tells me that Medidata's customers, satisfied with what Rave has done for their customers, are willing to spend more for Medidata's other offerings.

This metric has only been reported over the last four quarters, but it also shows remarkable growth for such a short time frame.

Source: SEC filings.

Though the company spends heavily on research and development, the business model is very profitable. Because of the cloud's scalable nature, each additional customer incurs only a slight bump in spending, meaning that additional revenue goes right to the bottom-line profit. That's why Medidata has been able to grow its gross margins from 48.9% in the second quarter of 2008 to 75.1% in the most recent quarter.

I'm betting that Medidata's growth story still has many chapters yet to be written, and I'm going to be along for that ride as an owner. If you're interested in another under-appreciated, high-growth player in the medical field, check out "What's Really Eating at America's Competitiveness." Inside, you'll discover a stock profiting as companies work to eradicate the efficiency-sucking tapeworm of high medical costs. Just click here for free, immediate access.

The article I'm Buying This High-Flying Stock Now originally appeared on Fool.com.

Fool contributor Brian Stoffel owns shares of Johnson & Johnson. The Motley Fool recommends Johnson & Johnson and salesforce.com. The Motley Fool owns shares of Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.