Is Zillow Up to Trulia's Challenge?

Without so much as lifting a finger, Zillow shares skyrocketed 18.7% last week on news of Trulia's record quarter. The online real estate company announces its own earnings Tuesday, and investors are waiting to find out whether this soaring stock is about to stumble. Here are the bull and bear cases for Zillow's future.

Buy, buy, buy!

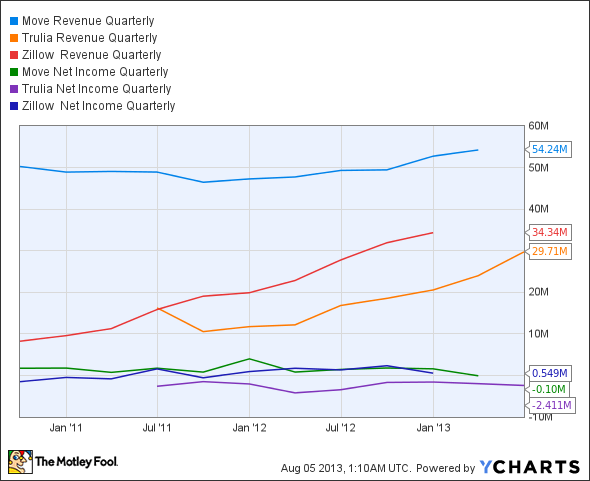

Trulia's earnings announcement was no fluke. Sales flew up 77% as share prices skyrocketed 20%, putting this player on the market map. Is this good news for Zillow? Absolutely. The real estate advertising business is estimated to be valued at $6 billion, and Trulia's second-quarter sales of $29.7 million only scratch the surface. Even without analyzing the dollar signs, the company's 50% year-over-year growth in monthly unique visitors hardly hints at a shrinking customer pool.

Even Move , owner of realtor.com, beat on both top and bottom lines last Friday. As an older player with a clunkier website and a slow start on the mobile revolution, the company has had a hard time keeping up with the astonishing 172% and 212% share price gains that Trulia and Zillow have chalked up.

But Move's not in growth mode the way those new whippersnappers are. Sales headed a seasonally adjusted 17% higher to $57.5 million, more than Trulia or Zillow have ever pulled in. The older company's earnings provide more permanent evidence that the online real estate world continues to expand, and there's plenty of profit for all the players.

Sell, sell, sell!

Everyone's looking for a way to play the housing recovery, and companies like Zillow and Trulia have found a titillating trifecta for traders: real estate, tech, and mobile. What's not to love?

First and foremost: profitability. You've got to have binoculars to see these companies' sustainable earnings. While sales have headed steadily higher over the past couple years, net income remains in the red zone.

MOVE Revenue Quarterly data by YCharts.

If these companies are serious businesses, they need a bottom line to prove it. For negligible net income, the valuations on these stocks are downright ridiculous. Zillow's forward P/E ratio stands at 161, Trulia's at 61, and Move's at 38.

The three companies are already sacrificing sales to fierce competition, and that's without considering start-ups ready to move markets or, dare I say it, Google deciding to finally take the real estate world by storm? The company hit the1 billion monthly unique visitors mark way back in June 2011, before Trulia was even a sparkle in Mr. Market's eye.

The search engine giant is no stranger to the real estate world. From 2009 to 2011, Google Maps offered real estate listings, but decided to end its innovation due to "low usage, the proliferation of excellent property-search tools on real estate websites, and the infrastructure challenge posed by the impending retirement of the Google Base API." While investors might still be scratching their heads as to why Google didn't take up the challenge in 2011 to get serious about real estate, there's really nothing stopping them from re-entering the arena today.

But seriously: buy or sell?

This bull and bear list only begins to scratch the surface of this controversial stock. Trulia's earnings should give Zillow investors hope -- but not without a dose of fear.

If Trulia's Q2 is any indicator, analysts' expectations for 60% top-line growth and an EPS loss of $0.11 for Zillow could be slightly conservative. But with the run-up in share prices over the last week, even an earnings beat might not be enough to keep Zillow shares from settling back down a bit.

Both companies live and die by the all-important network effect -- each vying for the attention of buyers, sellers, and everyone in between. Zillow reported a record 52 million monthly unique users in April, and investors will need to watch the growth of this metric more closely than any other to ultimately decide whether Zillow or Trulia (or both... or neither...) will win the real estate advertising market.

I own shares of Zillow myself, and this quarter's results (good or bad) will not be a game changer for me. However, as a responsible growth stock investor, I'll stay well aware of the bears.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped by just a handful of companies like Zillow. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

The article Is Zillow Up to Trulia's Challenge? originally appeared on Fool.com.

Fool contributor Justin Loiseau owns shares of Zillow and Google and once spent three weeks on couches in NYC trying to find a place to rent. You can follow him on Twitter @TMFJLo and on Motley Fool CAPS TMFJLo.The Motley Fool recommends Google and Zillow. The Motley Fool owns shares of Google and Zillow. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.