Is Red Hat Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Red Hat fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Red Hat's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Red Hat's key statistics:

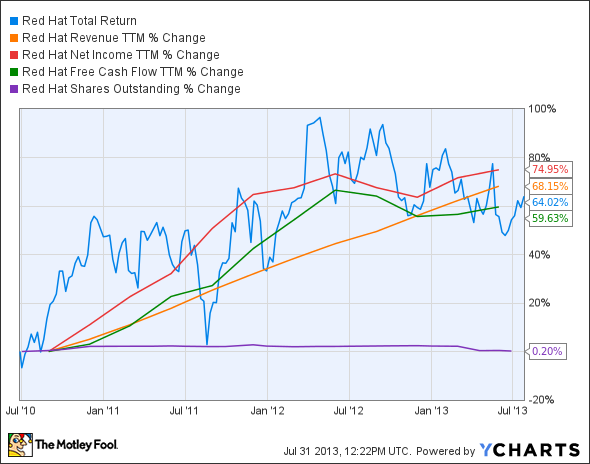

RHT Total Return Price data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 68.2% | Pass |

Improving profit margin | (6.2%) | Fail |

Free cash flow growth > Net income growth | 59.6% vs. 75% | Fail |

Improving EPS | 68.1% | Pass |

Stock growth (+ 15%) < EPS growth | 64% vs. 68.1% | Pass |

Source: YCharts. *Period begins at end of Q2 2010.

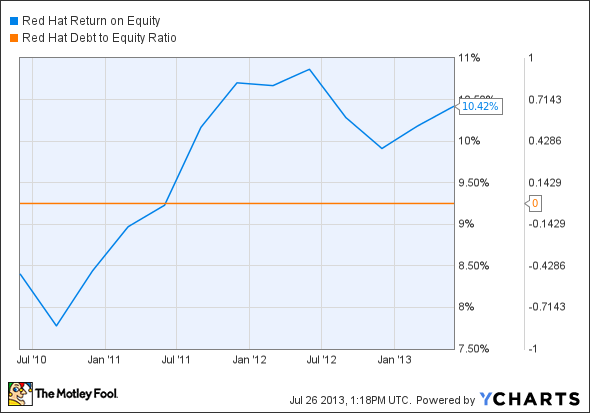

RHT Return on Equity data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 24% | Pass |

Declining debt to equity | No debt | Pass |

Source: YCharts. *Period begins at end of Q2 2010.

How we got here and where we're going

Red Hat looked promising, but it was tripped up on both profit margin and free cash flow growth, earning five out of seven passing grades in the end. Despite promising revenue gains, profit margins have declined somewhat. Net income growth has also outpaced free cash flow during our tracked period -- however, the raw numbers show that Red Hat's trailing-12-month free cash flow is actually almost twice as large as its net income. But does that mean Red Hat will do even better in the future? Let's dig a little deeper to find out.

In the last month's quarterly report, Red Hat reported a 15% increase in revenues while SaaS subscriptions grew by 16%. Total sales were $363 million, of which 87% came from subscriptions. Red Hat has increased its R&D spending substantially by investing in the "open hybrid cloud," which is the company's term for open-source cloud computing that covers a range of functionality and accessibility while allowing a great deal of development freedom. Red Hat has also launched a scalable Big Data management platform, which all but completes tech-buzzword bingo. All we need now is a mobile-social image sharing something or other.

All these Silicon Valley marketing buzzwords can make the non-techie investor's eyes cross, but Red Hat certainly seems set for robust growth in the future -- at least if the consistent growth in net income during the last few quarters can continue. However, Red Hat has no time to rest on its laurels. Cloud computing, despite being one of the hot tech trends of the young decade, has yet to displace the server infrastructure most large companies still depend on for both Web traffic and intranet purposes.

There are many players in the cloud game, but at this early stage, it's possible that most of them will wind up falling by the wayside. Red Hat's focus on open-source software could be the killer edge it needs to avoid obsolescence, but that alone is no guarantee -- developers can implement virtually any software they want on Amazon.com's Elastic Compute Cloud and Rackspace is every bit as committed to the "open cloud" as Red Hat. Of course, Red Hat currently brings nearly three times the annual free cash flow to the game as Rackspace, despite boasting a very similar P/E. Red Hat might not get the same attention as Rackspace, but it appears to be in a better position to take advantage of the open-source trend in cloud computing.

Putting the pieces together

Today, Red Hat has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

The article Is Red Hat Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Rackspace Hosting. It recommends and owns shares of Amazon.com. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.