Is Mosaic Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Mosaic fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Mosaic's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Mosaic's key statistics:

MOS Total Return Price data by YCharts

Passing Criteria | Three-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 47.6% | Pass |

Improving profit margin | 54.8% | Pass |

Free cash flow growth > Net income growth | (32.8%) vs. 128.4% | Fail |

Improving EPS | 139.3% | Pass |

Stock growth + 15% < EPS growth | (7.8%) vs. 139.3% | Pass |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

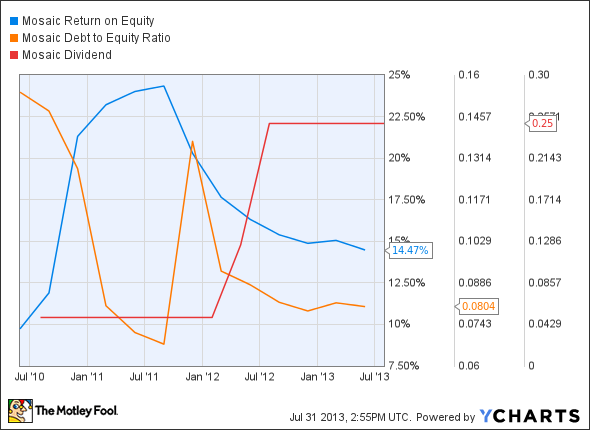

MOS Return on Equity data by YCharts

Passing Criteria | Three-Year* Change | Grade |

|---|---|---|

Improving return on equity | 48.8% | Pass |

Declining debt to equity | (47.8%) | Pass |

Dividend growth > 25% | 400% | Pass |

Free cash flow payout ratio < 50% | 142.6% | Fail |

Source: YCharts. * Period begins at end of Q2 (May) 2010.

How we got here and where we're going

Mosaic puts together a really strong performance, earning seven out of nine passing grades and narrowly missing an eighth on the free cash flow comparison. Over the past three years, Mosaic's falling free cash flow has evolved into its greatest fundamental challenge, and it may not be able to support current dividend payouts if the decline continues. Will Mosaic be able to move past this problem and rebound? Let's dig a little deeper to find out.

Last year, Mosaic benefited from exclusive contracts with emerging-market buyers in China and India, leading to a big improvement in its strained international distribution relationships. However, the company is now having a hard time selling products to farmers in both countries due to declining prices of potash and phosphate fertilizers. Weakening Indian rupees and reduced farm subsidies could continue to weigh heavily on agricultural chemical producers, particularly those, like Mosaic, that depend on potash sales. On the other hand, China has been subsidizing fertilizers to the point of overproduction, which hits Western potash producers from the other side. A terrible drought in the U.S. and dwindling sales from international markets could very well slow down Mosaic's growth in the near future.

Mosaic's immediate rival, PotashCorp , has also been hurt by the slowdown in Indian and Chinese markets. As Motley Fool contributor Maxx Chatsko notes, PotashCorp "is currently responding to oversupply by cutting production levels at its Lanigan and Rocanville mines". That might only even out the international imbalance caused by the Chinese glut, especially in light of this week's big fertilizer news:

Uralkali, the world's largest potash producer, broke an agreement with Belarus this week that had previously accounted for about 43% of global potash exports. As a result, potash prices are expected to plunge by 25% to about $300 per ton by the end of this year. A number of major potash-focused fertilizer producers, including both Mosaic and PotashCorp, saw share prices plunge by nearly as much as the expected price drop when the move was made public, and it seems like the drop is not done yet. Before this happened, Mosaic had plans to spend $6 billion on increasing its potash capacity to 11.6 million metric tons by 2015, and to 15 million metric tons by 2021. It remains to be seen if the company will continue with these plans in light of the devastating hit to its near-term profitability.

Putting the pieces together

Today, Mosaic has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

The most precious resource in the history of the world isn't gold. Or even oil. It's not even food! It might just be more valuable than all of them. Combined. And here's the crazy part: one emerging company already has the market cornered... and stands to make in-the-know investors boatloads of cash. We reveal all in our special 100% FREE report "The 21st Century's Most Precious Natural Resource". Just click here for instant access!

The article Is Mosaic Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.