1 Dow Stock You Shouldn't Dump Yet

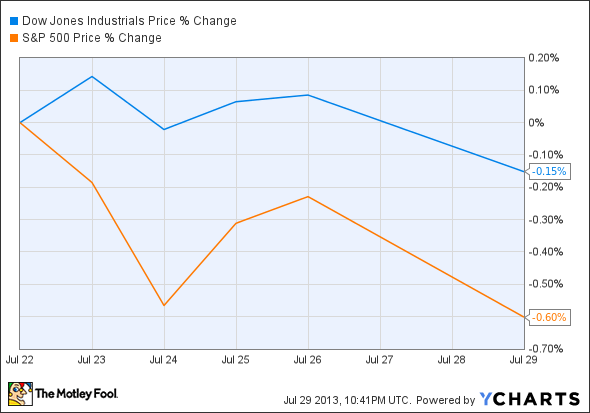

The Dow Jones Industrial Average tapered off 0.24% Monday to end down 37 points at 15,522. The S&P 500 took an even larger dip, dropping 0.37% on tough times for energy and financial stocks. After last week's upward trend and all-time high for the Dow, this week has started off decidedly slower.

Although Caterpillar reported lackluster earnings last week, it's not out of the limelight yet. The company thinks its stock is cheap, and it announced a $1 billion buyback program yesterday that pushed shares up 1.2%. Shares are still down 2.9% from last Monday, but a billion dollars is a lot to bet on a bluff.

Management remains optimistic, and long-term investors might want to explore Caterpillar more before throwing it to the bears.

Macro movers

The housing market seems to be unstoppable, with pending home sales beating expectations yesterday and other metrics at all-time highs. Today's S&P/Case-Shiller home price index will add another data point to the real-estate world, and it could support or refute claims of a housing "supply squeeze."

July's consumer confidence report hits the press at 10 a.m. EDT today, and analysts are expecting a slight drop from June's recovery high. Investors will need to keep a close watch on this indicator to see whether the economy's spenders are staying positive in the dog days of summer.

Never-ending earnings

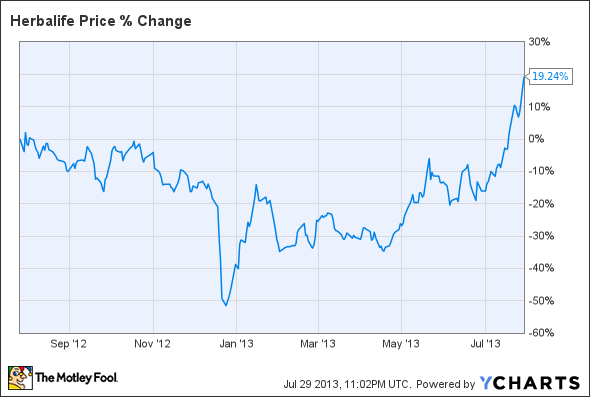

Herbalife reported earnings after market close yesterday, beating estimates on both the top and bottom lines. Sales clocked in at $1.22 billion, up 18% from Q2 2012 and $40 million above analyst estimates. Herbalife blew away bottom-line expectations, reporting $1.41 in adjusted EPS compared to predictions of $1.18 per share. Shares headed 3.6% higher during the day as investors hoped for the best, and they're up an additional 6.5% in premarket trading. Herbalife shares have been on a rollercoaster ride over the last year, pushed and pulled by iconic investors Carl Icahn and Bill Ackman. Herbalife CEO Michael Johnson is ignoring both the bull and the bear, pointing instead to "the success that our products and distribution model are having in markets around the world helping to mitigate the adverse effects of the obesity epidemic."

Riverbed Technology reports earnings after market close today, just one day after Wunderlich Securities downgraded the stock to a "hold" amid overvaluation fears. The company has enjoyed an average 16% annual growth rate over the past five years, but the last two years have left latecomer Riverbed investors up the creek without a paddle.

Lazard analyst Ryan Hutchinson still thinks Riverbed is still worth its weight, and he expects its recent OPNET acquisition to help boost synergies and cut costs. Analysts are expecting 30% top-line growth but are willing to let Riverbed by with a 4.3% bottom-line drop.

Riverbed's rollercoaster ride has many tech investors wanting out, but there's no reason you can't find sustainable earnings in rapidly rising tech markets. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

The article 1 Dow Stock You Shouldn't Dump Yet originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter @TMFJLo and on Motley Fool CAPS @TMFJLo.The Motley Fool recommends Riverbed Technology. The Motley Fool owns shares of Riverbed Technology and has the following options: long January 2014 $50 calls on Herbalife Ltd.. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.