This Dow Stock's Gains May Not Be Finished Yet

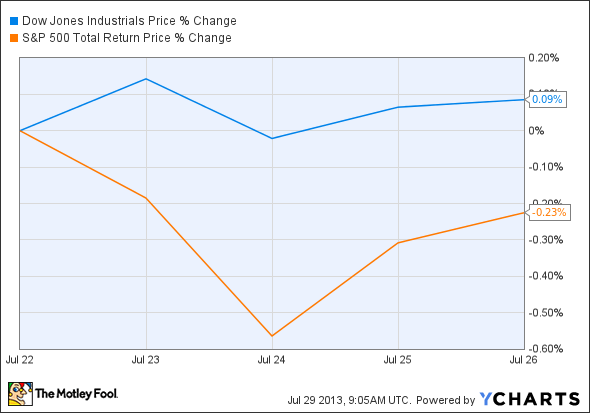

Last week, the Dow Jones Industrial Average ended up 0.09% at 15,559 points after hitting an all-time high Tuesday. The S&P 500 trailed Mr. Jones early in the week but managed to retake some of its gains for an overall 0.23% dip.

Sticky earnings

The last Dow stock to announce earnings last week was 3M , which reported on Thursday. The company missed on the top line but made up for it with slightly better-than-expected net income. 3M's $7.75 billion in revenue came in $20 million below estimates, but EPS added an extra penny to analyst predictions. Expectations aside, sales are up a seasonally adjusted 2.9%, while EPS rose 3%.

Management pointed to overall economic conditions as a continued drag on 3M's operations, but they have high expectations for increased demand in the coming quarters. Shares edged up 0.78% last week and have been boosted 12.6% over the last three months.

Macro Monday

Two macro reports hit the press today at 10 a.m. EDT. Pending home sales for June will add another data point to the housing market's recovery moves, although analysts are predicting a 1.4% drop after May's 6.7% rise, hitting levels unseen since 2006. New-home sales hit a recovery high last week, but ballooning home prices have some analysts worried about a "supply squeeze" bubble.

Investors will also get a taste of manufacturing's latest moves from the Dallas Fed Manufacturing Survey. Although this questionnaire is limited to the Lone Star State, analysts keep a close watch on regional manufacturing as a sign of overall economic improvement. The survey showed a positive perspective for June following a pessimistic April and May. Mr. Market expects manufacturers to keep their optimism up in July, with increasing new orders and company outlooks painting a pretty picture for Texas' future.

Monday movers

Coming up on the earnings calendar today are American Capital Agency and Herbalife , both reporting after market close.

American Capital is an mREIT (mortgage real-estate investment trust) with massive growth in recent years, but rising interest rates could put this stock on the chopping block. The company (and most other mREITS) have taken a dip in the past quarter, with American Capital shares down 34% in the last three months. According to Fool David Hanson, that means this earnings report may not be the big market-mover it could otherwise have been. Analysts aren't expecting much, but investors should keep a close watch to make sure the company's losses don't leave it overextended.

Likewise, Herbalife has seen its own shares rise and fall not on earnings reports, but on positive and pessimistic views expressed by prominent investors Carl Icahn and Bill Ackman, respectively. The company has consistently beaten earnings estimates over the past year, and shares are up a whopping 50.8% in the last three months. Wise investors will tune out Herbalife's stock market soap opera and focus on the fundamentals that count.

That's exactly what we do here at the Fool, and it has helped our analysts (and subscribers) make some of the smartest stock picks around. The Motley Fool's chief investment officer has selected his No. 1 stock for this year. Find out which stock it is in the special free report: "The Motley Fool's Top Stock for 2013." Just click here to access the report and find out the name of this under-the-radar company.

The article This Dow Stock's Gains May Not Be Finished Yet originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLoThe Motley Fool recommends 3M. The Motley Fool has the following options: long January 2014 $50 calls on Herbalife Ltd.. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.