Here's How You Can Profit From the United States' Oil Boom

Saudi Arabia can keep its oil, we have enough of our own. Photo Credit: Flickr/azrainman

It's an exciting time to be an energy investor. Oil production in the U.S. is booming and as oil prices stay high, it's easy to see a future in which U.S. oil production takes a giant leap forward. That future could yield real wealth-building profits for investors, which is why I'm going to show you where to look and how to invest in America's exciting oil future.

The Bakken is booming, but it's only the beginning

This past May, the Bakken set a new record for daily oil production at an average of 810,129 barrels of oil per day. That puts the play on pace to produce an average of 850,000 barrels of oil per day by year's end. That's a pretty big number, especially when considering the total output for the U.S. is around 7.3 million barrels of oil per day. It's even more impressive when considering that the Bakken has only been producing large quantities of oil for the past few years.

Looking into the future, there are projections that suggest the Bakken's production could double by 2017:

Source: Continental Resources Investor Presentation

Leading the charge is Continental Resources , which expects to triple its own oil production over that time frame. The company is already the region's largest producer, driller, and leaseholder. It has ambitious goals to triple production to over 300,000 barrels of oil equivalent per day by 2017. If Continental succeeds, it would produce an additional $20 million per day in revenue as long as oil stays over $100 a barrel. Investing in that growth today has the potential to really fuel the returns of a retirement portfolio.

Everything is bigger in Texas

While the Bakken was setting new highs, the Eagle Ford was quietly catching up to it as its average daily production sailed past 600,000 barrels of oil per day for the first time. At its current pace, the shale play has the potential to match or pass the Bakken within the next two years and it's expected to produce about 1.4 million barrels of oil per day by 2016.

That has the potential to really drive the results of producers focused on the Eagle Ford, such as Chesapeake Energy . The company produced an average of 75,000 barrels of oil equivalent per day last quarter, of which 65% was oil production. That production came from the company's 650 producing wells; however, looking ahead, Chesapeake sees the potential for 3,500 additional wells on its acreage. That means that it's still in the early innings in the Eagle Ford, giving investors plenty future upside by investing in its stock.

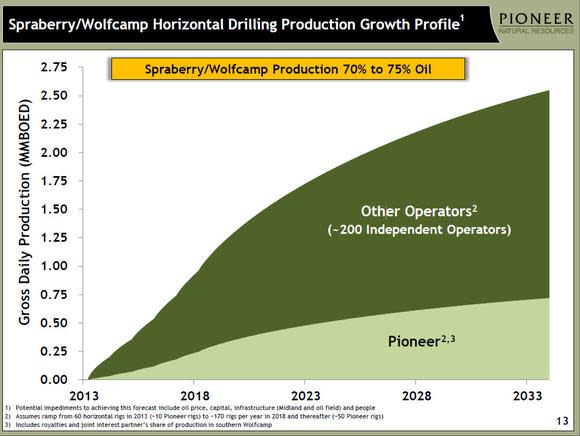

Despite the Eagle Ford's production and prospects, the big oil play in Texas could end up being in the Permian Basin. The legacy West Texas oil basin could hold enough oil to make it the second-largest oil field in the world. There are estimates that the Sparberry/Wolfcamp portion alone could produce upwards of a million barrels of oil equivalent per day by the end of the decade:

Source: Pioneer Natural Resources Investor Presentation

That potential has a company like Pioneer Natural Resources seeing a future that includes drilling more than 40,000 wells to capture over 9 billion barrels of potential oil equivalent production. That's $900 billion of potential oil in the ground for this $22 billion company. While it will cost a lot of money to get the oil out of the ground, it still makes for a very compelling investment opportunity.

Don't forget about the Gulf of Mexico

Last, but certainly not least is the Gulf of Mexico. It was once thought that the BP disaster in 2010 would turn off oil production in the Gulf for good. However, after three years of production declines, the Gulf is poised to not only rebound, but could double its production over the next few years:

Source: Enterprise Products Partners Investor Presentation

That's good news for producers like BP, as well as a variety of service companies like Enterprise Products Partners . The company is one of the many that are providing the region with infrastructure critical to get the oil from production platforms to the Gulf Coast refining complexes. One of its projects, the Lucius Crude Oil Export Pipeline, will move 115,000 barrels of oil per day from the deepwater Gulf of Mexico to refiners. This is just one of the many solutions that Enterprise is providing producers in the Gulf, which will help to give a really solid return to investors as the oil boom continues.

Final Foolish thoughts

I've really only scratched the surface of our oil potential. There are new shale plays emerging, and potential shale plays yet to be discovered, that have the potential to produce game-changing amounts of oil during the coming decade. This coming oil boom has the potential to build wealth for those who are invested before it really shifts into high gear.

As you can see, record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza". Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article Here's How You Can Profit From the United States' Oil Boom originally appeared on Fool.com.

Fool contributor Matt DiLallo owns shares of Enterprise Products Partners L.P. The Motley Fool recommends Enterprise Products Partners L.P. The Motley Fool has the following options: long January 2014 $20 calls on Chesapeake Energy, long January 2014 $30 calls on Chesapeake Energy, and short January 2014 $15 puts on Chesapeake Energy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.