Today's Best and Worst Dow Stocks

A midday rally has pushed the Dow Jones Industrial Average back to breakeven after the index started the day in the red due to some mixed reports on the U.S. economy. As of 1:25 p.m. EDT the Dow is flat, while the S&P 500 is up a mere 0.1%.

There were two U.S. economic releases today.

Report | Period | Results | Previous |

|---|---|---|---|

New unemployment claims | July 13-July 20 | 343,000 | 336,000 |

Durable-goods orders | June | 4.2% | 5.2% |

New unemployment claims were up 7,000 last week to a seasonally adjusted 343,000, right in line with analyst expectations of 342,000. The small rise brings the less volatile four-week moving average down by 1,250 to 345,250.

US Initial Claims for Unemployment Insurance data by YCharts.

New unemployment claims continue to average below last year's level of 360,000 to 370,000, indicating a slowly strengthening economy.

The other economic release today was the durable-goods orders report. The Department of Commerce revised May's report upward from 3.7% growth to 5.2% growth. June's durable-goods orders rose 4.2%, far above analyst expectations of 2.3% growth. The downside to the report, however, is that if you exclude the transportation sector, durable-goods orders were unchanged from May. The transportation sector's results can be highly volatile, so it's good to consider durable-goods orders ex-transportation. Both for the whole economy and for the transportation sector, shipments were unchanged, so in the transportation sector, at least, the second half of the year may see stronger manufacturing activity in the U.S. than in the first half of the year.

Today's worst Dow stock is Home Depot , down 2.1% after homebuilders Pulte and D.R. Horton both reported disappointing earnings results. The stocks are down about 12% and 9%, respectively, after the companies reported lower-than-expected orders and home deliveries. The disappointing results are weighing on Home Depot, whose stock has been bid up on hopes of a resurgent housing market. Given the recent rise in mortgage rates, investors are worried that the housing market will stumble, and these results give some credence to that view. It remains to be seen whether the rise in rates has created a buying opportunity or the housing market has peaked in the short run.

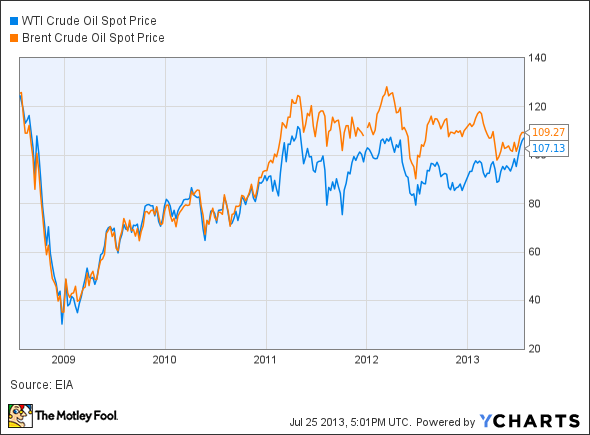

Today's Dow leader is Chevron , up 1%. Chevron is benefiting from the relatively high price of oil around the world. The past few months have seen the spread between WTI crude and Brent crude finally close from the highs hit the past few years.

WTI Crude Oil Spot Price data by YCharts.

Chevron has been actively searching for new opportunities, and it recently signed a joint development agreement with Argentina's newly nationalized oil company YPF. Fool analyst Sean Williams recently rained praise on Chevron CEO John Watson, who, since taking the reins in 2010, has led the company to an 81% gain from shareholder-friendly capital-allocation decisions, including buybacks and dividend increases.

If you're looking for other dividend payers that would make solid long-term investments, you're invited to check out The Motley Fool's brand-new special report, "The 3 Dow Stocks Dividend Investors Need." It's absolutely free, so simply click here now and get your copy today.

The article Today's Best and Worst Dow Stocks originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool recommends Chevron and Home Depot. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.