Is Taiwan Semiconductor Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Taiwan Semiconductor fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

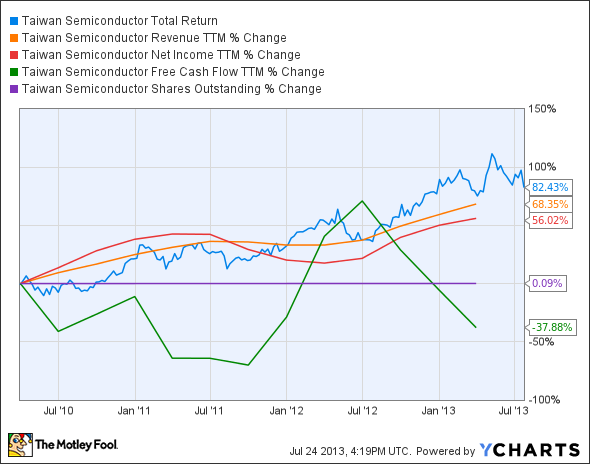

The graphs you're about to see tell Taiwan Semi's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Taiwan Semi's key statistics:

TSM Total Return Price data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 68.4% | Pass |

Improving profit margin | (7.3%) | Fail |

Free cash flow growth > Net income growth | (37.9%) vs. 56% | Fail |

Improving EPS | 56.1% | Pass |

Stock growth (+ 15%) < EPS growth | 82.4% vs. 56.1% | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

TSM Return on Equity data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (12.6%) | Fail |

Declining debt to equity | 236.2% | Fail |

Dividend growth > 25% | 7.7% | Fail |

Free cash flow payout ratio < 50% | 276.3% | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we're going

Taiwan Semi doesn't back up its strong price appreciation by earning a measly two out of nine passing grades today. The company's big weakness of late is falling free cash flow, which now rests far below its net income (although it remains in solidly positive territory for the time being). Can Taiwan Semi's shareholders continue to earn market-beating returns, or is chip-making not the moneymaker it was once thought to be? Let's dig a little deeper.

Applesigned a three-year deal with Taiwan Semi in the past month to build the upcoming A8, A9, and A9X chips -- a deal that seemed to show Apple moving away from Samsung as its supplier-slash-frenemy of choice. But Apple is apparently still utilizing Samsung fabs to build A9 chips for future iterations of the iPhone, starting in 2015. Apple also made a deal with Samsung for future 14-nanometer chips, which means that Samsung has beaten out Taiwan Semi to the 14-nanometer transistor size. The Taiwanese company, despite being one of the very major few chip fabs left, couldn't get get a 14-nanometer production line up and running in time for Apple's anticipated launch.

However, Apple's new partnership with Taiwan Semi has resulted in a dedicated chip fabrication facility that should allow the iPhone maker a chance to reduce its reliance on Samsung for one of the most important components in its devices. Apple had previously offered Taiwan Semi sizable investments to guarantee dedicated capacity, only to be rebuffed as Taiwan Semi sought to maintain its flexibility. To ensure such flexibility in light of the new deal, Taiwan Semi has also been branching out into LED lighting and solar energy. Moving beyond its core business isn't without risks, but these two industries continue to grow by leaps and bounds. If management pulls it off, Taiwan Semi's flagging free cash flow -- no doubt a consequence of equipment investments -- could turn up in a big way. At the very least, the revenue from these two areas could even out the cyclicality of its chip business.

As the largest chip foundry, Taiwan Semi has the size to maintain reliable profitability, where fabless chip makers tend to vacillate between red and black ink. If Apple continues to shift production to Taiwan Semi and away from Samsung, Taiwan Semi will have a massive new customer that can singlehandedly boost its bottom line -- provided that the world doesn't fall out of love with iStuff, that is.

Putting the pieces together

Today, Taiwan Semiconductor has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Apple has a history of cranking out revolutionary products -- and then creatively destroying them with something better. Read about the future of Apple in the free report "Apple Will Destroy Its Greatest Product." Can Apple really disrupt its own iPhones and iPads? Find out by clicking here.

The article Is Taiwan Semiconductor Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Apple. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.