Halliburton Raises Buyback Program to $5 Billion

Having repurchased 23 million shares, or $1 billion worth of company stock, in the second quarter, oil services giant Halliburtonannounced today it had approved an increase to $5 billion in its buyback program.

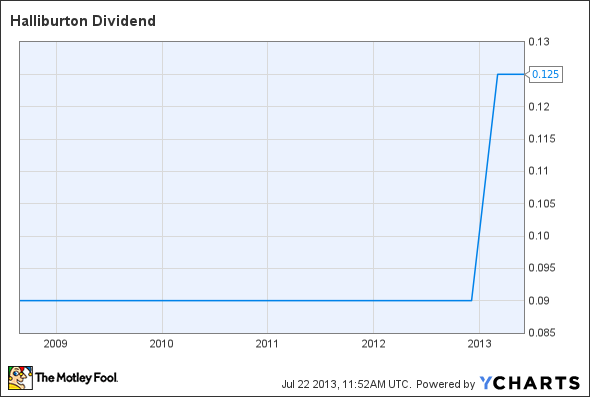

The board of directors said that with just $0.7 billion of repurchasing capacity remaining on the existing authorization that was initiated in 2006, it would increase by another $4.3 billion its ability to buy back shares. It also declared its third-quarter dividend of $0.125 per share, the same rate it's paid for the last two quarters after having increased the payout 39% from $0.09 per share.

Noting the first-quarter dividend hike reflected management's increased confidence in the strength of the company's outlook, Halliburton Chairman, President, and CEO Dave Lesar said, "We believe that our relentless focus on generating best-in-class returns and our commitment to shareholder distributions will deliver increased value to our shareholders going forward."

The regular dividend payment equates to a $0.50-per-share annual dividend, yielding 1.1% based on the closing price of Halliburton's stock on July 19.

HAL Dividend data by YCharts.

linkHalliburton also reported second-quarter numbers today. For the quarter ended June 30, Halliburton's net income totaled $679 million, or $0.73 per share. Analysts expected $0.72 per share, according to FactSet. A year ago, earnings were $737 million, or $0.79 per share.

Overall revenue edged up 1% percent to $7.32 billion from $7.23 billion a year ago, also topping expectations despite an 8% revenue slide in North America. Total revenue, even with the decline in North America, was an all-time best for the second quarter, helped by international growth, especially in Asia.

-- Material from The Associated Press was used in this report.

The article Halliburton Raises Buyback Program to $5 Billion originally appeared on Fool.com.

Fool contributor Rich Duprey has no position in any stocks mentioned. The Motley Fool recommends Halliburton. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.