The 1 Market Investors Are Overlooking

U.S. stocks are lower this morning, with the S&P 500 and the narrower, price-weighted Dow Jones Industrial Average down 0.19% and 0.16%, respectively, at 10:05 a.m. EDT.

Emerging markets

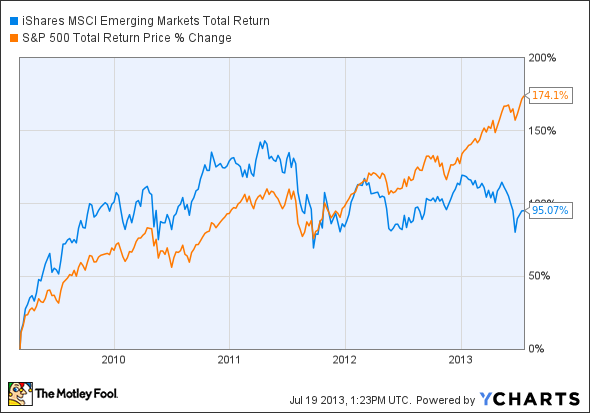

In fact, investors are abandoning or overlooking more than just a single market - it's an entire asset class: Emerging market equities. The effect is clear; the following graph shows the stark divergence in performance, on a total return basis, between the U.S. stock market and emerging markets:

EEM Total Return Price data by YCharts

Emerging markets are lagging by some 30 percentage points over a period of little more than half a year! Lest you think this is simply a correction following a period of wild outperformance by emerging markets, take a look at the following, which highlights the relative performance of both indexes from the bear market bottom of March 9, 2009:

EEM Total Return Price data by YCharts

The argument for emerging markets is not the familiar "GDP growth is higher" chestnut - which, in any event, is fallacious -- instead, it's based on a much more robust line of reasoning: they're simply cheaper than the U.S. market.

Last October, asset allocation expert Mebane Faber put the cyclically adjusted price-to-earnings (CAPE) ratio of the MSCI Emerging Markets Index ETF at 15.3, against 21.6 for the S&P 500. Since then, the gap in valuations has widened, as the S&P 500's CAPE has risen to nearly 24. While I don't have an updated figure for the Emerging Markets ETF, the underlying index has fallen 3.7% in dollar terms over that period (even in local currency terms, it's flat), so it's a safe bet its CAPE is lower today than it was then. (The CAPE is based on average real earnings over a trailing 10-year period, which, on average, increases over time in a very stable manner.)

That valuation gap will almost certainly manifest itself in the years to come with a performance gap -- in favor of emerging markets, this time. On Tuesday, another asset allocation specialist, fund manager GMO, will give its seven-year asset class return forecasts as of the end of June. Those forecasts have emerging market equities generating an annualized return of 7% after inflation against negative 1.2% for large-capitalization U.S. equities. That's a massive difference, but it's consistent with the difference in valuations

Personally, I recently added the iShares MSCI Turkey Investable Market Index Fund to my model portfolio, after recent concern over political stability knocked the Turkish market down. I think patient, value-oriented investors might consider doing the same in their real-money portfolios.

Alternatively, if you're looking for the "best of both worlds," a recent Motley Fool report, "3 Strong Buys for a Global Economic Recovery," outlines three companies that could take off when the global economy gains steam. Click here to read the full report!

The article The 1 Market Investors Are Overlooking originally appeared on Fool.com.

Fool contributor Alex Dumortier, CFA has no position in any stocks mentioned; you can follow him on LinkedIn. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.