Anworth Raises Preferred Conversion Rate

Externally managed real estate investment trust Anworth Mortgage Assetannounced yesterday that it is increasing the conversion rate on its 6.25% Series B cumulative convertible preferred stock from 3.8695 shares of its common stock to 3.9202 shares effective July 9.

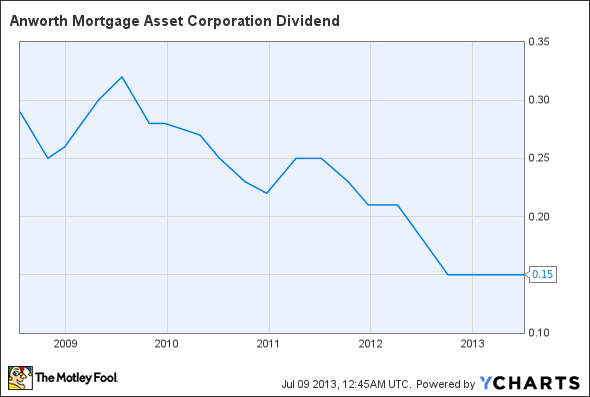

The REIT said it had announced last month it would be paying a dividend of $0.15 per share on its common stock, but in accordance with the terms of its preferred shares, if the annualized yield on that dividend exceeds 6.25%, the conversion rate on the Series B preferred stock is adjusted. The formula used is set in the preferred stock's articles, and as a result of the dividend to be paid on July 29, the conversion rate will change.

The regular dividend payment equates to a $0.60-per-share annual dividend, yielding 12.8% based on the closing price of Anworth Mortgage Asset's stock on July 8.

ANH Dividend data by YCharts.

The article Anworth Raises Preferred Conversion Rate originally appeared on Fool.com.

Fool contributor Rich Duprey has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.