Is Merck Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Merck fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Merck's story, and we'll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Merck's key statistics:

MRK Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 38.1% | Pass |

Improving profit margin | (63%) | Fail |

Free cash flow growth > Net income growth | 232.5% vs. (48.9%) | Pass |

Improving EPS | (61.4%) | Fail |

Stock growth (+ 15%) < EPS growth | 43.8% vs. (61.4%) | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

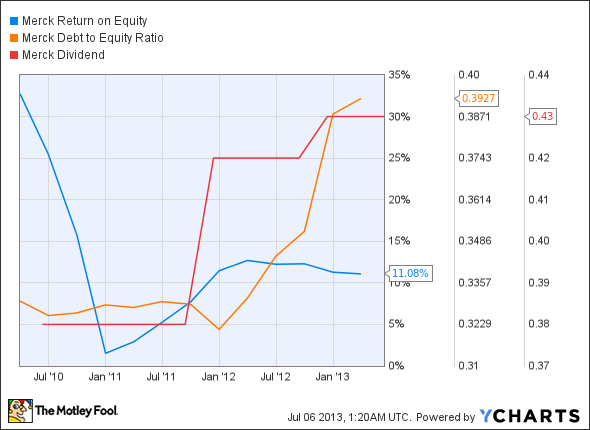

MRK Return on Equity data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (66.2%) | Fail |

Declining debt to equity | 19% | Fail |

Dividend growth > 25% | 13.2% | Fail |

Free cash flow payout ratio < 50% | 63.9% | Fail |

Source: YCharts.

*Period begins at end of Q1 2010.

How we got here and where we're going

Merck, despite its status as one of the world's largest pharmaceutical companies, doesn't look too impressive here, as it earns only two out of nine possible passing grades. Despite this apparent inadequacy, Merck's shares have made an impressive comeback over the past six months, and have finally reclaimed the multiyear highs left behind early in 2008. Merck's trailing-12-month free cash flow is almost 33% more than its net income, which puts it in a stronger position -- however, so much of this cash is being spent on dividend payments that the company may not have much financial wiggle room going forward. Let's dig a little deeper to see what Merck is doing to maintain or grow its position.

Let's get the patent cliff out of the way first: the pharmaceutical industry is staring at a revenue loss of around $300 billion due to patent expirations this decade. Like many of its peers, Merck has faced a significant decline in revenues and profitability due to last year's patent expiration of Singulair, its best-selling drug (accounting for 11% of 2011 revenues). Sales of anti-hypertensive drugs such as Cozaar and Hyzaar have also declined by 26% since losing market exclusivity in U.S. and European markets in 2010. Moreover, Merck's brain tumor treatment Temodar, and hit prostate-and-bald-patch pill Propecia, should also see generic competition in the coming year.

Merck's hardly alone in its losing battle against generics. One of the best-selling drugs in history went off-patent in November 2011 -- Lipitor, the anti-cholesterol drug that was Pfizer's golden goose, generating close to $9.6 billion in sales in its last patent-protected year.

Going forward, the Merck's revenues will be supported by the sales of other drugs such as diabetes treatment Januvia, which recorded 18% sales growth to $1.1 billion in the fourth quarter. A broad revenue base, with robust growth from its diabetes franchise and its vaccines, should partly offset Merck's patent pain until the company can establish a new base of blockbusters and return to growth after weaning itself off Singulair's hefty sales. Merck's long-term growth potential is significant, based on a slew of new treatments for atherosclerosis, thrombosis, and hepatitis C. Out of these, Barclays estimates that osteoporosis drug hopeful Odanacatib could generate $2 billion in annual sales by 2020. Merck doesn't seem to be overly dependent on any one particular drug in its pipeline. However, Anacetrapib for atherosclerosis and MK-8931 for Alzheimer's could both produce significant revenue streams.

Merck's new R&D head Roger Perlmutter is moving quickly to overhaul Merck's Research Laboratories (MRL). Various senior management roles have also been eliminated to streamline Merck's operating model and reduce its cost structure. Merck also remains attractively valued, boasting a forward P/E of 13.2 and a price-to-book at the lower end of its historical valuation. The company has also announced that it will buy back up to $15 billion of its shares, which should provide some positive momentum depending on how smartly the buyback is managed.

Putting the pieces together

Today, Merck has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Obamacare will undoubtedly have far-reaching effects. The Motley Fool's new free report, "Everything You Need to Know About Obamacare," lets you know how your health insurance, your taxes, and your portfolio could be affected. Click here to read more.

The article Is Merck Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes and The Motley Fool have no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.