The 3 Biggest Risks Facing the Stock Market

There are always risks facing investors, but macro economic risks can often be the most devastating for those who aren't expecting them. Think back to the financial crisis in 2008, and how much wealth was lost in a crisis few saw coming. During the last four years, the stock market has had an incredible run, with the DowJones Industrial Average and S&P 500 both rising about 100%.

Stock markets don't rise forever, though, and there are some major risks facing the market today. Below are the three that I think investors should be most concerned about.

China falling apart

Last week, China's Shanghai stock market fell 5.3% in a single day, and interest rates skyrocketed when it appeared the country's banks would have a liquidity crisis. This would have been similar to what happened with banks in the U.S., when investors panicked and failed to loan them money, eventually causing a capital crunch only the Federal Reserve and Congress could help fix.

China isn't in a dissimilar place, but its banks aren't as open as ours. The government-run banks essentially execute the strategy of the central government, loaning to industries the government wants to support, often with little ability to pay them back (see the solar or electric vehicle industries). These loans fuel growth and investments that would otherwise be impossible to make in open markets.

Without easy money from banks, Chinese companies couldn't grow as rapidly as they have, and the country's GDP wouldn't be growing near double digits. A few small dominos falling over could tip the country into crisis.

A trade war with Europe or the U.S. could be the first step on the way to crisis. Here's one small, but symbolic, example: Europe and the U.S. have launched tariffs on China's solar exports, and China has responded by launching an investigation into Europe's wine industry and threatens tariffs on U.S. solar imports into China.

To make matters even more contentious, China has been stealing trade secrets and other intellectual property for years, and that may finally be coming to a head now that it's the second largest economy in the world. Last week, American Superconductor's trade dispute with China was taken to another level when the Department of Justice indicted former AMSC partner Sinovel for stealing trade secrets. All indications are that this should have been an open-and-shut case in China, but the Chinese court system has thrown out the case, or dragged its feet for two years.

China is still, at its core, an export country, and starting a trade war, bursting in housing, or a liquidity crisis could be terrible for both China and the U.S. Goldman Sachs recently lowered China's 2014 growth estimate to 7.7%, from 8.4% -- a dramatic drop -- and if China can't grow, and its financial and economic markets deteriorate, the fallout would be global.

Interest rates

It's almost impossible for long-term interest rates to be lower than they have been in the U.S. But fast rising interest rates could act as a brake to the housing market and the entire economy.

Interest rates have jumped a full percentage point over the past two months, and it may already be having an impact on housing. Ironically, if the jobs market continues to steadily improve, rates will go up, which is good long-term, but it will have a big impact on mortgage rates and corporate bonds.

To put interest rates into perspective on your pocketbook, a $250,000 30-year fixed-rate mortgage at 4% will cost $1,194 per month. If rates go up 1%, to 5%, that monthly payment goes up 12%, to $1,342 per month, and a 7% rate is a whopping 39% jump to $1,663 per month. So, rising interest rates have a big impact on almost everyone in the U.S.

The risk here is that, if interest rates rise too fast, it will bring the housing market to a screeching halt, and consumers could clam up again, bringing economic demand to a halt. This is the Fed's biggest concern, but it's also one of the top risks to the market right now.

What is Europe doing?

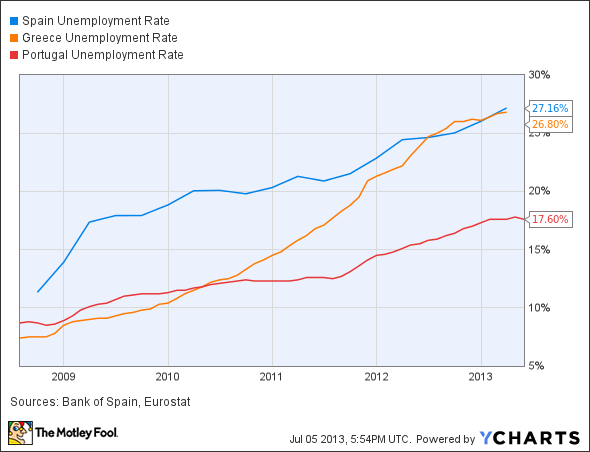

Europe is still a mess. The flaws of a single currency system have been exposed, and austerity measures in troubled countries have left them with high unemployment and an endless recession. This week, Portugal lost key government officials, and there was concern from both European and global markets that austerity measures may be in question, and we'll be in for upheaval again. If you're a citizen in Greece, Portugal, or Spain, the anger is understandable.

The table below shows the unemployment rate of three of the hardest-hit countries in Europe, and there's no end in sight to employment problems in these regions.

Spain Unemployment Rate data by YCharts

The risk for investors in the U.S. is that Europe's crisis tips over the edge and there's a default, bailout plans are pulled, or the recession-gripping parts of Europe get even worse. This week's mini-freak-out over Portugal shows just how important European markets can be to investors. A spreading crisis is still a huge risk for investors.

Foolish bottom line

There are always risks to investors, and these three macro factors are worth keeping an eye on. China and the Fed have helped drive the market for four years and, if both are working against investors at the same time, it isn't a good sign. Then there's Europe, which can pop up and scare investors at a moment's notice.

Macro economic risks can't be avoided, but you can prepare by buying high-quality companies with a long history of solid returns. The Motley Fool has compiled a special free report outlining our nine top dependable dividend-paying stocks. It's called "Secure Your Future With 9 Rock-Solid Dividend Stocks." You can access your copy today at no cost! Just click here.

The article The 3 Biggest Risks Facing the Stock Market originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.