Is Honeywell Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Honeywell fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Honeywell's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Honeywell's key statistics:

HON Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 21.1% | Fail |

Improving profit margin | 64.7% | Pass |

Free cash flow growth > Net income growth | (26.4%) vs. 87.1% | Fail |

Improving EPS | 80.6% | Pass |

Stock growth (+ 15%) < EPS growth | 88.5% vs. 80.6% | Pass |

Source: YCharts. * Period begins at end of Q1 2010.

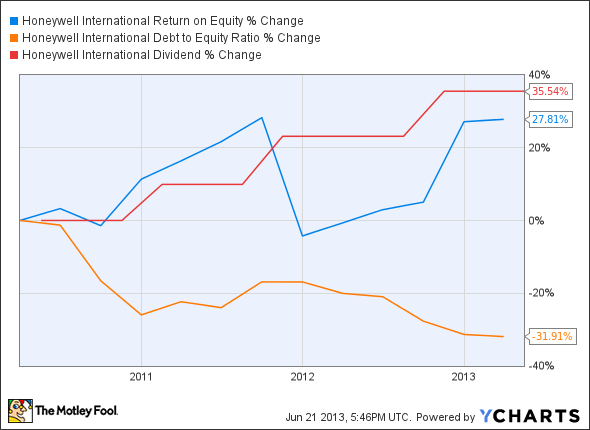

HON Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 27.8% | Pass |

Declining debt to equity | (31.9%) | Pass |

Dividend growth > 25% | 35.5% | Pass |

Free cash flow payout ratio < 50% | 44.6% | Pass |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we're going

Honeywell comes through with flying colors, earning seven out of nine passing grades and narrowly missing an eighth due to slightly underwhelming revenue growth since 2010. This is a strong performance, but can Honeywell keep up the progress? Let's dig a little deeper to find out.

Its most recent quarterly earnings were a nice surprise, as Honeywell boosted earnings despite relatively flat revenue. More importantly, free cash flow -- the one weak link in our analysis -- posted a big increase year over year, which points to a possible eighth passing grade on our next analysis, should the trend keep up. More recently, the company bought out a small-ish gas and radiation detector manufacturer, which could be a nice easy bolt-on to existing business. But that's not the only positive news.

Embraer has contracted Honeywell to provide avionics for its new E-Jet platform, which has already gained hundreds of orders and could have hundreds more in the wings. Honeywell's helicopter business also appears bullish, predicting double-digit growth in most parts of the world for the global chopper industry. And after some battery problems, Boeing's 787 may finally be cleared for production takeoff, which is good news for 787 lighting-system supplier Honeywell. Generally, CEO David Cote is at least "cautiously optimistic" about the growth of the whole company, which was a harder stance to take at the end of 2012.

Since that prediction, Honeywell's begun to branch out in unexpected ways, as it's now working with utilities such as PG&E to provide residential energy-management platforms. The "smart grid" is growing in fits and starts, but it's one of the more optimistic corners of tomorrow's economy, so it's good for Honeywell investors to see the company dipping a toe in these waters.

Putting the pieces together

Today, Honeywell has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Boeing operates as a major player in a multitrillion-dollar market in which the opportunities and responsibilities are absolutely massive. However, emerging competitors and the company's execution problems have investors wondering whether Boeing will live up to its shareholder responsibilities. The Fool's premium research report on the company provides investors with the must-know issues surrounding Boeing. They'll be updating the report as key news hits, so don't miss out -- simply click here now to claim your copy today.

Keep track of Honeywell by adding it to your free stock Watchlist.

The article Is Honeywell Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool recommends Embraer-Empresa Brasileira. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.