Why Dow Stocks Are Down as the Fed Foresees Economic Recovery

The Dow Jones Industrial Average continues its fall following Federal Reserve Chairman Ben Bernanke's comments yesterday, while today's economic releases were mixed but by no means bad. The markets' fall shows that investors are skeptical of Bernanke's rosy economic outlook and are worried about the effects of slowing Fed asset-purchases. As of 1:20 p.m. EDT the Dow is down 248 points, or 1.64%, to 14,864, with all 30 components in the red. The S&P 500 is down 1.76% to 1,600.

Bernanke's press conference

Yesterday, after the release of the Federal Open Market Committee statement, Bernanke held a press conference where he told reporters he expected hiring to accelerate over the next few years such that the unemployment rate could hit the Fed's target of 6.5% as soon as late 2014.

The market's fall accelerated after Bernanke said the Fed could begin slowing its asset purchases as soon as the end of this year, so long as its forecasts for inflation and unemployment are correct. He specifically mentioned that the Fed could start tapering as soon as unemployment hits 7%. The markets, particularly the U.S. mortgage market, are currently being propped up by the Fed's buying of $85 billion worth of long-term assets each month -- that's $45 billion in long-term Treasuries and $40 billion in mortgage-backed securities. Reduced asset purchases means higher interest rates, because the Fed will no longer artificially inflate demand for securities by buying in such huge quantities.

A gradually improving economy

Generally, all assets fall when the market panics, and this time around has been no different. The bond market, stock market, and commodities markets are all down for the day.

The Fed will slow purchases as the economy strengthens, which means the Fed sees signs of a self-sustaining recovery. Today's four U.S. economic releases today lent credence to that view.

Report | Period | Result | Previous |

|---|---|---|---|

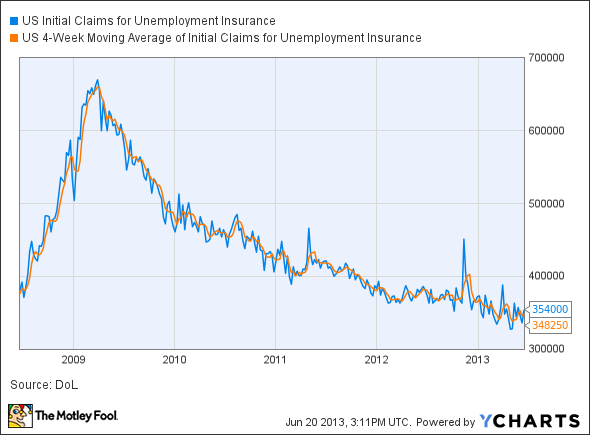

New unemployment claims | June 8 to June 15 | 354,000 | 336,000 |

Markit flash purchasing managers index | June | 52.2% | 52.3% |

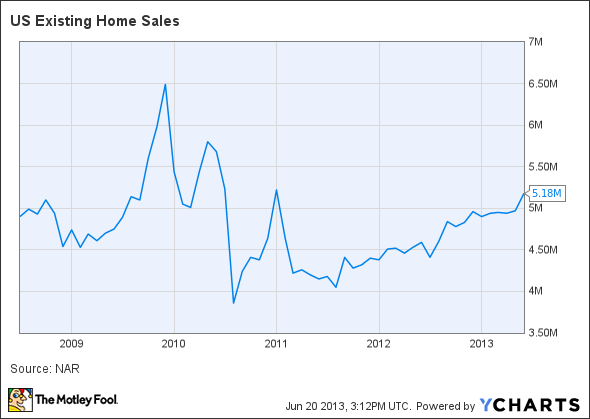

Existing home sales | May | 5.18 million | 4.97 million |

Leading indicators | May | 0.1% | 0.8% |

The key reports here are unemployment claims and existing-home sales. While new unemployment claims rose 18,000 to 354,000, unemployment claims are volatile from week to week and shouldn't be read into that much. The more stable four-week moving average of unemployment claims rose by only 2,500 to 348,250.

US Initial Claims for Unemployment Insurance data by YCharts.

Unemployment claims have been slowly improving this year and remain below last year's average of 360,000 to 370,000, signaling a stronger economy.

Existing-home sales have also been improving, rising to a seasonally adjusted 5.18 million in May from 4.97 million in April. The housing market is being bolstered by a lack of inventory, as builders largely stopped building during the financial crisis. That lack of inventory now means homeowners and homebuilders are in a great position to profit as the economy improves and more Americans enter the market for houses.

US Existing Home Sales data by YCharts.

Foolish bottom line

While the economy is improving, all 30 Dow stocks are down for the day as fear of the unknown spreads and rates continue to mount. The drop may look scary, but to put it in perspective, the Dow is still up more than 13% for the year, and Dow stocks are only down to the level they saw early last month.

Long-term investors would do well to ignore the market's ups and downs, focus on their investing plans, and keep their wits about them. If the drop continues, opportunities will arise for long-term investors to pick up undervalued companies.

One company that is an undervalued beneficiary of higher interest rates is Bank of America. While its stock doubled in 2012, many smart investors believe there is more yet to come. With significant challenges still ahead, it's critical to have a solid understanding of this megabank before adding it to your portfolio. In The Motley Fool's premium research report on B of A, analyst Anand Chokkavelu, CFA, and financials bureau chief Matt Koppenheffer lift the veil on the bank's operations, detailing three reasons to buy and three reasons to sell. Click here now to claim your copy.

The article Why Dow Stocks Are Down as the Fed Foresees Economic Recovery originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.