Signet Sets $350 Million Buyback Plan and Dividend

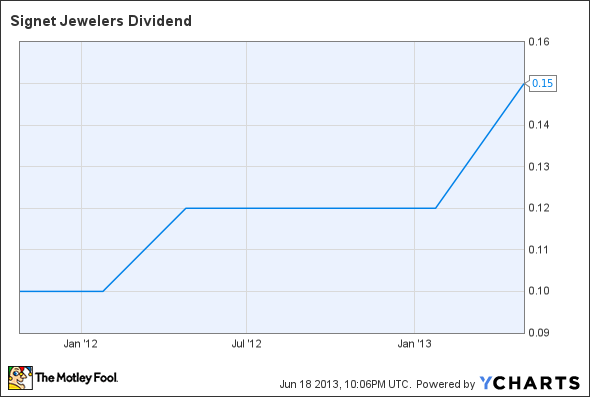

Specialty jeweler Signet Jewelers announced today its third-quarter dividend of $0.15 per share, the same rate it paid last quarter after raising the payout 25% from $0.12 per share.

The board of directors said the quarterly dividend is payable on Aug. 28 to the holders of record at the close of business on Aug. 2. The jeweler has made quarterly payouts to investors since 2011.

The regular dividend payment equates to a $0.60-per-share annual dividend, yielding 0.9% based on the closing price today of Signet Jewelers' stock.

SIG Dividend data by YCharts.

The board also announced it was authorizing up to $350 million to repurchase company shares. The stock that's bought back -- which may be achieved through open-market transactions, block trades, or other means -- may be used for company purposes rather than being retired.

Signet CEO Mike Barnes was quoted as saying: "The share repurchase authorization reflects our ongoing commitment to build long-term value for our shareholders, the continued confidence we have in the strength of our business, and our ability to generate free cash flow after investment in our growth initiatives." The jeweler said the program can be started, suspended, or cancelled at anytime.

The article Signet Sets $350 Million Buyback Plan and Dividend originally appeared on Fool.com.

Fool contributor Rich Duprey and The Motley Fool have no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.