Is EMC Stock Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does EMC fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell EMC's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at EMC's key statistics:

EMC Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 49% | Pass |

Improving profit margin | 12.4% | Pass |

Free cash flow growth > Net income growth | 65.3% vs. 115.2% | Fail |

Improving EPS | 104.2% | Pass |

Stock growth (+ 15%) < EPS growth | 36.8% vs. 104.2% | Pass |

Source: YCharts. * Period begins at end of Q1 2010.

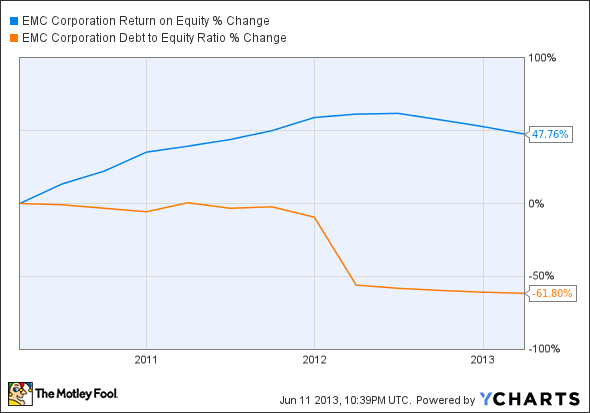

EMC Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 47.8% | Pass |

Declining debt to equity | (61.8%) | Pass |

Dividend growth > 25% | Pass | |

Free cash flow payout ratio < 50% | Not yet established | N/A |

Source: YCharts. * Period begins at end of Q1 2010.

How we got here and where we're going

EMC puts together a really strong performance, missing out on a perfect score only because net income has outpaced free cash flow during our tracked period -- however, the raw numbers show that EMC's trailing-12-month free cash flow is actually almost twice as large as its net income. That makes it an even more appealing value, as its price-to-free cash flow ratio is presently barely in double-digit territory. But does that mean EMC will keep outperforming in the future? Let's dig a little deeper.

Six months ago, my colleague Selena Maranjian looked at the pros and cons of EMC, noting that EMC's majority ownership of cloud specialist VMware offers beneficial synergies that boost both companies. EMC's networked storage solutions aren't free from competition, however, since the primary advantage in this arena is simple cost and convenience. VMware has since slid from its 2012 levels following disappointing growth reports, which is less a concern for EMC since VMware is still growing -- just not as quickly. EMC also happens to be outpacing NetApp in direct competition, as the latter's 4% product revenue growth came in below EMC's result earlier this year.

EMC also benefits from excellent corporate governance, which allows investors to feel comfortable knowing that their shares should be free from any insider shenanigans. That won't prevent EMC from suffering if its core business comes under attack, but long-term investors know that nothing is risk-free.

EMC might not worry the market with some unexpected restatements anytime soon, but investors do need to pay attention to the company's effort to move further into data analytics through VMware and through its own initiatives. This isn't an easy nut to crack -- IBM is already well-established in this fast-growing field, and other specialists have also built years of experience into defensible moats. EMC will have to play catch-up, and the cost of doing so might not bring the market share the company needs. On the other hand, combining its storage solutions with analytics could provide the edge EMC needs -- health care's transition to the realm of big data (especially when it comes to data-gushing genome screens) will need plenty of space in the cloud.

Putting the pieces together

Today, EMC has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

The article Is EMC Stock Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool recommends and owns shares of VMware. It also owns shares of EMC and IBM. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.