The 2 Most Popular Stocks Last Week

According to Yahoo! Finance, the following two stocks received the most quote page views last week. The first one won't surprise you, but the second one almost certainly will.

Apple

Apple may no longer be hedge funds' favorite stock, but its appeal remains very broad among institutional and individual investors alike -- which is hardly surprising, considering it is the world's most valuable brand and (once more) the most valuable company, ahead of ExxonMobil.

Last week, news flow concerning Apple was fairly negative, ranging from its legal disputes to reports that the iPhone maker is losing ground to Samsung in China and the United States. Shares were down 1.8% on the week, compared with a 0.9% gain in the megacap Dow Jones Industrial Average . That sentiment could shift next week, which coincides with Apple's World Wide Developer Conference (June 10-14, in San Francisco). As one might expect, there are plenty of rumors swirling around the WWDC, with speculation about the release of iRadio or an iWatch, but the focus is likely to be on the new iPhone operating system, iOS7, and (to a lesser degree) the new version of OS X -- Apple-centric blog AppleInsider reports that new signage has been added displaying simply "7" and "X."

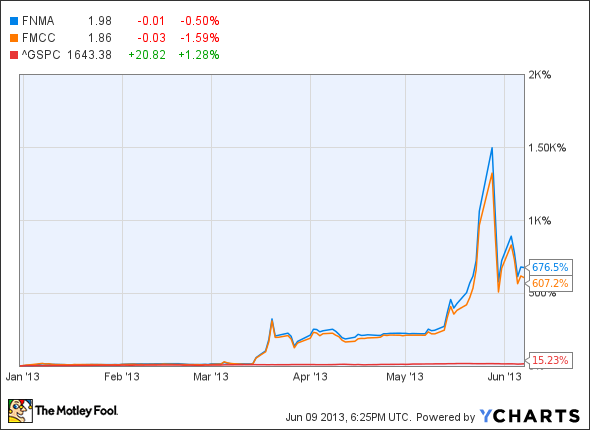

Federal National Mortgage Association

Federal mortgage agency Federal National Mortgage Association, known as Fannie Mae, is a conundrum, and a speculative vehicle par excellence. On the back of a spectacular 676% run-up this year (see the following graph), the company has become, to my knowledge, the most valuable over-the-counter penny stock there is. With its twin, the Federal Home Loan Mortgage Corp. , both of which were nationalized in 2008, during the credit crisis, these companies now have a combined market value of $5.5 billion.

Last week, details emerged about the potential timetable for the government's plans for the two agencies. Given that the draft legislation from a bipartisan group of senators calls for the agencies to be wound down within five years, the shares' rise now appears to be a case of the triumph of (speculative) hope over reality. Though the shares are down significantly from their May high, there could be plenty of air to come out of them yet. I'd strongly recommend individual investors avoid these issues, except as an alternative to a trip to Vegas (which sounds like more fun, anyway.)

There's no doubt that Apple is at the center of technology's largest revolution ever and that longtime shareholders have been handsomely rewarded, with more than 1,000% gains. However, there is a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on reasons to buy and reasons to sell Apple and what opportunities are left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

The article The 2 Most Popular Stocks Last Week originally appeared on Fool.com.

Fool contributor Alex Dumortier, CFA, has no position in any stocks mentioned; you can follow him on LinkedIn. The Motley Fool recommends and owns shares of Apple. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.