It May Be a Good Time to Buy Kroger Stock. Here's Why

It might not be obvious to the casual observer, but right now, today, Kroger stock offers one of the best values available in the supermarket industry. Why?

Three reasons.

Kroger is cheap

When you stack up Kroger stock against a couple of its smaller, faster-growing rivals -- Harris Teeter and The Fresh Market , it's clear that Kroger is the cheapest of the three. Its 12.0 price-to-earnings ratio is barely half the price Harris Teeter stock-shoppers pay, and less than a third of the price of a share of Fresh Market.

Now as I just mentioned, both Harris Teeter and Fresh Market aregrowing faster than Kroger. Analysts have Kroger pegged for a bit more than 7% annual earnings growth over the next five years, while Harris is expected to grow a bit less than twice as fast, and Fresh Market a bit less than three times as fast. Emphasis on "a bit less" -- as in, the disparities in growth rates aren't big enough to justify the discounts on Kroger stock: about two times versus Harris, and more than three times versus Fresh Market.

Kroger's a proven performer

It's worth bearing in mind, too, that projections of future growth are really just guesses -- and investors may be better advised to invest their money in facts. Over the past five years, Kroger has grown its profits at a very respectable 9.6% clip. So even if Harris Teeter might grow faster than Kroger in the future, we know for a fact that its historic 4% earnings growth rate hasn't measured up to Kroger's. Similarly, analysts who hope to see Fresh Market outgrow Kroger by a factor of three in future years must admit that, so far, it hasn't even been able to double Kroger's growth rate.

Kroger pays you best

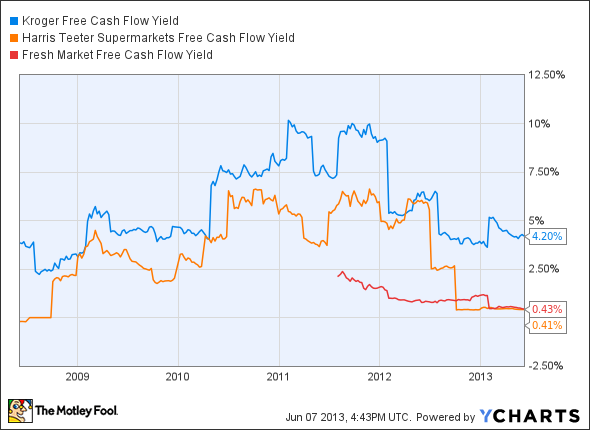

Perhaps most important to investors, though, is the simple fact that out of the three supermarket stocks discussed above, Kroger is the firm generating the most cash from its business -- by far -- and Kroger stock gives you the biggest free cash flow bang for the buck.

Measured by dividing a firm's market capitalization (the price you pay for Kroger stock) into its free cash flow (the money your investment generates for you), Kroger offers investors quite simply the best "free cash flow yield" of the three firms named. Put even more simply, for every $1 you invest in a share of Kroger stock today, you can expect the firm to generate 4.2 cents' worth of real, cash profits on your investment.

KR Free Cash Flow Yield data by YCharts.

Kroger may ultimately use this cash to pay you bigger dividends (it already pays a 1.8% dividend -- 37% better than Harris Teeter's divvy, and Fresh Market pays no dividend at all!). Or Kroger could use its cash to buy back shares (increasing the size of your stake in the company for every share it takes off the table), or to reinvest in its business and shore up its lead over the would-be up-and-comers. Any way you look at it, though, Kroger's ability to generate cash offers investors a great reason to invest.

And that, Fools, is the reason I think now's a great time to buy Kroger stock.

Can you really make good money investing in a boring old grocery store? Actually, yes. Whole Foods investors have reaped more than 30 times their initial investment over the past 20 years. And it may not be too late to participate in the long-term growth of this organic foods powerhouse. In this premium report on the company, we walk through the key must-know items for every Whole Foods investor, including the main opportunities and threats facing the company. So make sure to claim your copy today by clicking here.

The article It May Be a Good Time to Buy Kroger Stock. Here's Why originally appeared on Fool.com.

Fool contributor Rich Smith has no position in any stocks mentioned. The Motley Fool recommends The Fresh Market and Whole Foods Market. The Motley Fool owns shares of Whole Foods Market. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.