Bill Ackman 1, Procter & Gamble Management 0

U.S. stocks opened lower this morning, with the S&P 500 and the narrower, price-weighted Dow Jones Industrial Average down 0.78% and 0.57%, respectively, at 10:05 a.m. EDT. Barring a significant reversal, that puts the S&P 500 on track to record its first weekly loss since mid-April.

P&G: McDonald is out as CEO

Bill Ackman, the brash hedge-fund manager at the head of Pershing Square Capital Management, can now add a head to his trophy wall from his campaign at the world's largest consumer-products company, Dow component Procter & Gamble . Late Thursday, P&G replaced CEO Bob McDonald with his retired predecessor, A. G. Lafley -- effective immediately.

In recent years, P&G has struggled to find its focus and adapt to a consumer who has adopted a more frugal mind-set in the post-crisis era. Shareholder returns during Mr. McDonald's tenure have been disappointing:

PG Total Return Price data by YCharts.

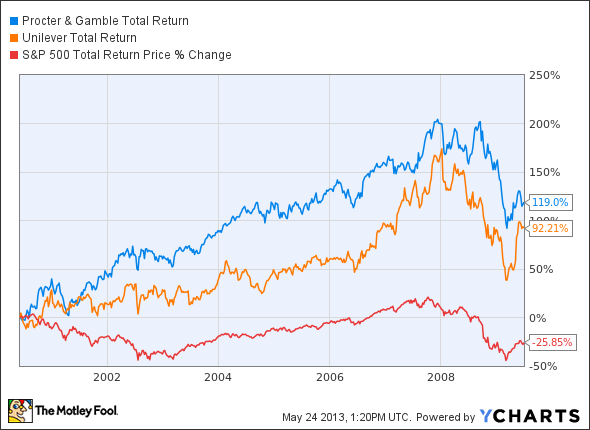

Mr. Lafley, on the other hand, was widely respected for his leadership and the turnaround he implemented at the company. The following graph shows the total return of P&G shares relative to that of the S&P 500 and its closest peer, Unilever, between June 8, 2000, when Lafley was first appointed CEO, through June 30, 2009, the end of his term as CEO:

PG Total Return Price data by YCharts.

P&G shares trounced the broad market and beat their nearest competitor in the process. That performance was no fluke: It was the result of operational improvements. As Lafley wrote in May 2009: "Since 2000 P&G's market TSR has outperformed that of the S&P 500 and the Dow Jones Industrial Average. Over the same period, on average, P&G has grown organic sales, diluted earnings-per-share, and free cash flow ahead of long-term targets."

Will Lafley be able to work his magic again? He knows the company intimately, so he'll be able to hit the ground running. He'll need it -- with Ackman watching over him, he won't have infinite time to show results.

If you're looking for some long-term investing ideas, I invite you to check out The Motley Fool's brand-new special report, "The 3 Dow Stocks Dividend Investors Need." It's absolutely free, so simply click here now and get your copy today.

The article Bill Ackman 1, Procter & Gamble Management 0 originally appeared on Fool.com.

Fool contributor Alex Dumortier, CFA has no position in any stocks mentioned; you can follow him on LinkedIn. The Motley Fool recommends Procter & Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.