Better Buy: Nike Stock or Under Armour?

Ever since Under Armour CEO Kevin Plank founded his company in 1996, he's held the industry dominance of Nike squarely in his sights. Plank even used to send a Christmas card every year to Nike founder Phil Knight that read, "You will hear about us one day."

In fact, during one memorable exchange at a football game between Under Armour-sponsored University of Utah and Nike-clad University of Oregon, Plank asked Knight if he wanted to make a bet on the game.

Knight only turned, and replied with a smile, "I think we already have."

Two market-beaters

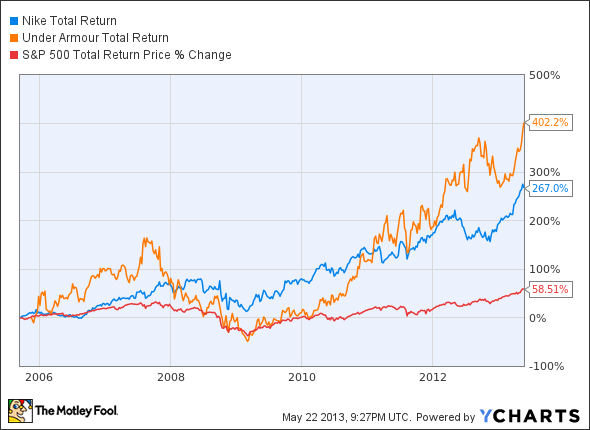

So far in 2013, both Under Armour and Nike stocks have handily outperformed the otherwise respectable 17% return offered by the S&P 500:

NKE Total Return Price data by YCharts.

That raises the question: Which is the better stock for investors to buy now?

Everyone likes an underdog

While Under Armour has embraced the role of being the little guy so far, its stock has more than tripled over the past five years. As a result, Under Armour's current market capitalization at nearly $7 billion has finally pushed the budding company out of mid-cap territory and into the big leagues. What's more, shares of Under Armour admittedly look expensive as they trade hands at more than 55 times last year's earnings, and 35 times next year's estimates.

Still, looks can be deceiving, and there's a reason Under Armour has long stood out as one of my favorite stocks.

So how much more can Under Armour possibly grow? Despite increasing year-over-year revenue by at least 20% each quarter for the past three years, Under Armour management continues to stand by their long-term goal of maintaining that 20% growth for the foreseeable future.

And while the stock might still look a bit rich -- even with that growth -- investors have every reason to believe Under Armour is only just getting started, as international revenue only accounted for 6% of last year's sales. Of course, that's not lost on the company, and recent quarters have seen a significant push by Under Armour executives to further develop their international business.

In addition, as I noted last month, UA's footwear revenue rose 43% last quarter from the year-ago period to $45 million, so it appears the company's success in apparel should be able to translate to the multibillion-dollar footwear market -- and remember, Under Armour only began making shoes in 2006.

The case for the industry stalwart

So why might you want to buy shares of Nike?

Relative stability, for one. Though Under Armour may have outperformed Nike stock since the smaller company's IPO in November 2005, investors may have needed an airsickness bag to really enjoy those gains:

NKE Total Return Price data by YCharts.

By contrast, folks who held Nike stock over the same period enjoyed a much steadier climb.

In addition, while Under Armour may enjoy greater overall growth potential at one-eighth of Nike's current market capitalization of almost $58 billion, Nike sports a higher net profit margin of 9.2% (compared to Under Armour's at just 6.3%). Even better, Nike also has a fortress-like balance sheet with more than $4 billion in cash and investments, and just $161 million in long-term debt. As a result, Nike shareholders can collect a solid 1.3% dividend yield while Nike stock trades at a much more reasonable 25 times last year's earnings, and 21 times next year's estimates.

Survey says...

So which stock is the better buy today? Truthfully, it depends on your particular investing needs.

Nike is a undoubtedly a solid, lower-risk company that will likely be rewarding shareholders long after you and I are gone. However, if you have a long-term time frame and don't mind taking the added risk (and wild price swings) of investing in a smaller growth company, I still think Under Armour will ultimately prove the better bet down the road.

And behind door No. 3...

Looking for another athleticwear stock with promise? lululemon athletica has the potential to grow its sales by 10 times if it can penetrate its other markets like it has in Canada -- but the competitive landscape is starting to increase. Can Lululemon fight off larger retailers and ultimately deliver huge profits for savvy investors? The Motley Fool answers these questions and more in its most in-depth Lululemon research available. Thousands have already claimed their own premium ticker coverage; gain instant access to your own by clicking here now.

.

The article Better Buy: Nike Stock or Under Armour? originally appeared on Fool.com.

Fool contributor Steve Symington owns shares of Under Armour. The Motley Fool recommends Nike and Under Armour. The Motley Fool owns shares of Nike and Under Armour. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.