How Dividends and Buybacks Change the Game for IBM Shareholders

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

This time, we'll look at the bluest chip on the market. IBM has been around for a century, and it sets the pace for the Dow Jones Industrial Average -- not only by being a rock-solid business but also by having the largest share price among the 30 components. Due to the Dow's price-weighted nature, IBM accounts for more than 10% of the elite index's value.

Today, for example, IBM shares gained 0.7% and added 12 points to the Dow; the seventh-largest percentage move on the Dow translated to the third-largest point change.

This stock is a market-crushing beast in the long run. It has gained 64% over the last five years (versus the Dow's 19%), 135% in a decade, and 440% in 15 years. And that's before you account for reinvested dividends.

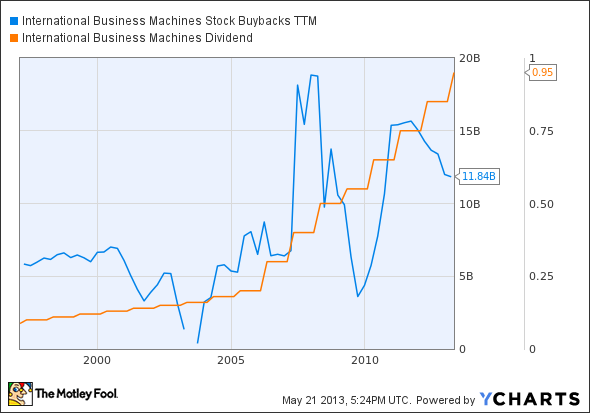

You might scoff at IBM's modest 1.9% yield, which sits below the Dow's average. But you can blame that on rising share prices, which are rarely seen as a bad thing. And dividends are not the only vehicle IBM employs to return value to shareholders.

IBM Stock Buybacks TTM data by YCharts.

Between 2008 and 2012, IBM spent $15.7 billion on dividend payouts -- generous, to be sure. But the company also spent a net $45.8 billion on share buybacks in that short span (IBM repurchased $60.4 billion in shares while printing $14.6 billion in new shares). That's four times the dividend expense and accounts for nearly 20% of IBM's current market cap. That oft-overlooked policy plays a serious role in IBM's shareholder value proposition.

If you're looking for some long-term investing ideas, you're invited to check out The Motley Fool's brand-new special report, "The 3 Dow Stocks Dividend Investors Need." It's absolutely free, so simply click here now and get your copy today.

The article How Dividends and Buybacks Change the Game for IBM Shareholders originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of IBM. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.