Why Citigroup Stock Is Surging

It's a good day to own bank stocks. The industry overall is up considerably in afternoon trading. With roughly an hour left in the trading session, the KBW Bank Index , an index tracking 24 large banks, is up by 1.65%, with many of its components trading even higher.

Turning in one of the best performances among banks today is Citigroup , which is watching as its shares move higher by more than 2% higher at the time of writing. As I noted earlier today with Bank of America, most financial news outlets are attributing the surge to the bullish comments of a hedge fund manager who appeared this morning on CNBC.

According to David Tepper of Appaloosa Management, "If the Fed doesn't taper back, we're going to get into this hyper-drive market. It's a backwards argument. To keep the markets going up at a steady pace the Fed has to taper back." In other words, at least in Tepper's opinion, the market is headed higher irrespective of whether or not the central bank pulls back on quantitative easing -- assuming, of course, that it does so in a restrained manner.

While there's no question that the Fed is at least partially behind the ongoing bull market, when it comes to a bank like Citigroup, there's at least one additional variable at work: valuation. Like Bank of America, Citigroup's troubles during the financial crisis, and the bank's subsequent financial atonement, have driven down its multiple.

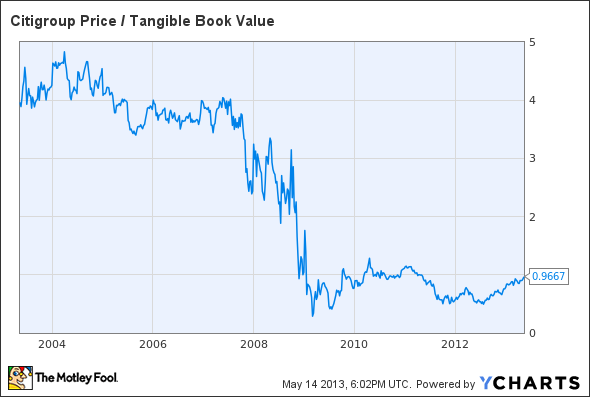

C Price / Tangible Book Value data by YCharts.

As you can see in the chart above, prior to the financial crisis, it was trading for anywhere from three to four times tangible book value. Since then, however, it's regularly exchanged hands for less than one times tangible book. And this has been particularly notable since the middle to end of 2011, around which time its shares were being valued at roughly half of book value.

The point is this: On days like today, when the market is generally higher, banks that are trading for a relative discount to their tangible book value stand a better chance of outperforming the sector. And that's precisely what we're seeing this afternoon with Citigroup.

Is Citigroup still cheap?

Citigroup's stock looks tantalizingly cheap. Yet the bank's balance sheet is still in need of more repair, and there's a considerable amount of uncertainty after a shocking management shakeup. Should investors be treading carefully, or jumping on an opportunity to buy? To help figure out whether Citigroup deserves a spot on your watchlist, I invite you to read our premium research report on the bank today. We'll fill you in on both reasons to buy and reasons to sell Citigroup, and what areas that Citigroup investors need to watch going forward. Click here now for instant access to our best expert's take on Citigroup.

The article Why Citigroup Stock Is Surging originally appeared on Fool.com.

John Maxfield owns shares of Bank of America. The Motley Fool owns shares of Bank of America and Citigroup. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.