Here's How PNC Fared in the Stress Tests

On Thursday evening, the Federal Reserve released the results of the Dodd-Frank annual stress tests for the largest U.S. bank holding companies. The capital ratio estimates for PNC Financial Services highlighted the importance of not simply looking at the numbers.

Don't judge a book by its cover

Compared to last year's stress test results, PNC's Q3 Tier 1 common capital ratio of 9.5% was actually lower, while the majority of its peers showed improvement year over year. However, the decline in PNC's capital ratio was not due to souring loans or increased risky assets. The reduction of its Tier 1 common ratio was driven by the bank's acquisition of RBC Bank in its effort to expand into new markets. The move involved adding $1.1 billion in goodwill which is not included in the calculation of Tier 1 common equity.

Sources: Dodd-Frank Act Stress Test 2013: Supervisory Stress Test Methodology and Results. Comprehensive Capital Analysis and Review 2012.

The main purpose of the Fed's stress tests is not to look at actual capital levels, but rather to examine the how these institutions would fare if the domestic and global economy experienced another downturn similar to several years ago. In the "severely adverse" economic scenario, which included a sharp contraction in U.S. GDP coupled with 12% unemployment and a 20% decline in real estate values, PNC's Tier 1 common ratio only fell to a minimum of 8.7%, an improvement of 210 basis points from last year's stressed ratios.

Consistent improvement

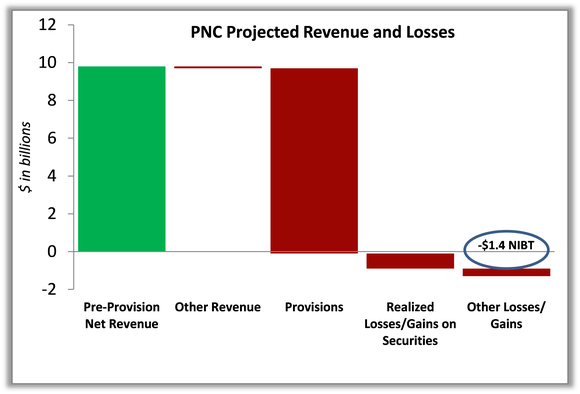

In addition to sporting improved stressed ratios, PNC's operational side also showed stark improvement compared to last year's tests. Over the nine-quarter doomsday scenario, the Fed projected PNC to see its Pre-Provision Net Revenue (essentially a measure of operating profit) fall to $9.8 billion, and Provision for losses to creep up to $9.8 billion. The total net income before taxes for the period was estimated at -$1.4 billion, compared to the -$8.9 billion estimated in last year's harshly tested scenario.

Source: Dodd-Frank Act Stress Test 2013: Supervisory Stress Test Methodology and Results

While PNC is attempting to aggressively move in the Southeastern part of the U.S. to expand its consumer business, the majority of the bank's loan loss exposure continues to stem from commercial loans and real estate.

Source: Dodd-Frank Act Stress Test 2013: Supervisory Stress Test Methodology and Results

Looking ahead

Next Thursday, the Fed will release Comprehensive Capital Analysis and Review (CCAR) results, which will look very similar to these results, but will take into consideration any of PNC's proposed increases in dividends or share repurchases. Last year, PNC requested and received approval to increase its dividend. Given PNC's increased earnings potential and relatively strong stress test results, shareholders may be expecting another bump in the quarterly payout.

The big banks may be rushing to renew their focus on traditional banking, but well-run regional banks like PNC Financial are already there. PNC saw its share of hardships during the financial meltdown, but its management team thinks the bank is now back on track and ready to deliver for investors. Does this mean it's time to buy PNC? To help you figure that out, one of The Motley Fool's top banking analysts has authored a brand-new premium research report, delving into everything investors need to know about PNC today. To claim your copy, simply click here now for instant access.

The article Here's How PNC Fared in the Stress Tests originally appeared on Fool.com.

David Hanson has no position in any stocks mentioned. The Motley Fool owns shares of PNC Financial Services. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.