Gaming Stock Duel: MGM Resorts vs. Caesars Entertainment

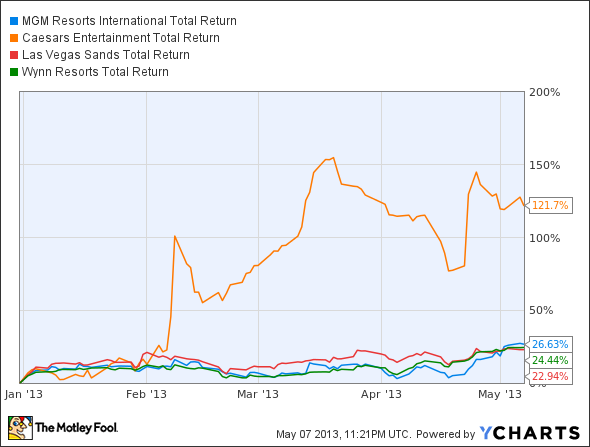

Shares of Caesars Entertainment have been on a tear this year, jumping 122% to lead the gaming industry. The stock has easily surpassed its closes competitor MGM Resorts , and is outperforming LasVegas Sands and Wynn Resorts , who have a lot of exposure to Macau.

MGM Total Return Price data by YCharts

But, operationally, Caesars isn't the shining star it is on the stock market. Recently released first-quarter earnings numbers showed a 3% decline in Caesars' revenue, and every operating region was down. Atlantic City was the worst, falling 15.5%, after Hurricane Sandy ran through town and there really weren't any bright spots to point to.

On the other hand, MGM Resorts continues to make slow and steady progress, driven by Macau. Overall, revenue was up 3% and domestic wholly owned resorts saw a 12% jump in EBITDA. Macau was a solid performer, with revenue up 6%, to $748 million, and EBITDA was up 10% to $180 million.

The one negative for MGM was that debt hasn't been reduced from unsustainably high levels. Net debt at the end of the first quarter was $12.4 billion, up slightly from $12.25 billion at the end of 2012. It's important to note that MGM China did pay a $500-million dividend, of which $255 million went to MGM. Due to the way consolidated accounting works, this dividend actually increased net debt, so that accounted for a little bit of the net debt increase. I'd just like to see debt falling at a steady clip now that operations are improving.

No matter how you slice it, MGM Resorts is a much better company operationally than Caesars Entertainment. MGM China has already broken ground on a Cotai project that will add 1,600 hotel rooms, 2,500 slots, and 500 table games, which should be wildly profitable. The resort will sit between Wynn's new resort, and Las Vegas Sands' Cotai Central, and could add nearly $1 billion in EBITDA to the company.

How to play Caesars' growth

If you're still enamored by Caesars, and are interested in buying into the Caesars growth spinoff, it's best to wait until the company actually becomes public. By buying Caesars today, you're getting a chance to buy into the company, but that will take extra cash, and you'll still be stuck with the "no growth" portion of the company.

For my money, MGM Resorts is the best of the two, and I think it will out perform Caesars, as Las Vegas recovers and it opens a new resort in Macau.

More on MGM Resorts

When MGM Resorts began constructing the CityCenter in Las Vegas, it was an audacious plan that seemed like a sure bet with its prime location in the center of The Strip. But Las Vegas hit a rough patch during the Great Recession and has yet to fully recover, so MGM has since turned its attention to a new market in Macau. This Chinese gaming enclave now holds the key to the company's future, and a new resort on Cotai may relieve the company from crushing debt. For expert analysis on whether this former high-flying stock can regain its form on the back of a growing presence in Asia, you're invited to check out The Motley Fool's new premium report on MGM Resorts. Simply click here now to claim your copy today.

The article Gaming Stock Duel: MGM Resorts vs. Caesars Entertainment originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of Wynn Resorts, Limited. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.