515 Monthly Income Payments and Counting at Realty Income

When you've been paying dividends for 515 consecutive months, as Realty Income has, you're allowed to set the payout as it does, to the seventh decimal point. The real estate investment trust yesterday declared a dividend in the amount of $0.1812292 per share that is payable on June 17 to shareholders of record as of June 3.

The REIT also declared dividends on its monthly income Class E preferred stock in the amount of $0.140625 per share, and on its Class F preferred stock in the amount of $0.138021 per share. The dividends on the preferred stock are payable on June 17 to shareholders of record as of June 1.

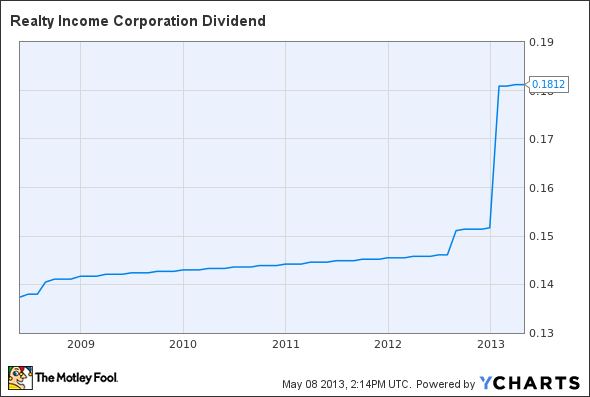

Throughout its 44-year operating history, Realty Income has consistently paid dividends and has increased the payout 71 times since its listing on the New York Stock Exchange in 1994.

The regular dividend annualizes to approximately $2.175 per share and yields 4.2% based on the closing price of Realty Income's stock as of May 7. The Class E preferred stock annualizes at $1.6875 per share while the Class F preferred stock annualizes to $1.65625 per share.

O Dividend data by YCharts.

The article 515 Monthly Income Payments and Counting at Realty Income originally appeared on Fool.com.

Fool contributor Rich Duprey has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.