Why This Quarter Is Crucial for MAKO Surgical

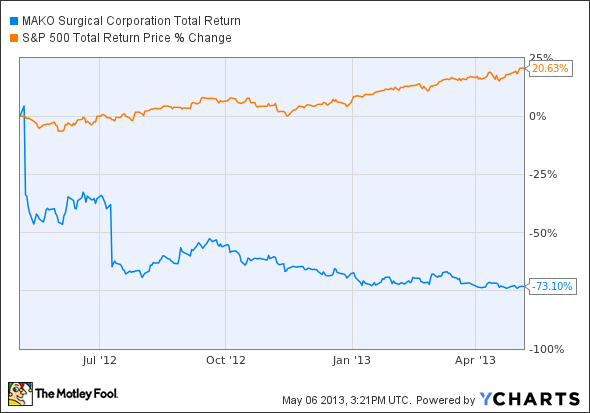

MAKO Surgical sure has taken investors on quite the ride over the past year. The problem, however, is that the ride has looked more like a downhill ski run than anything else:

MAKO Total Return Price data by YCharts.

Of course, those massive drops last May and July were the direct result of two horrific quarters during which the robotic orthopedic surgery specialist badly missed RIO system sales estimates. As a consequence, management not only had to twice reduce sales guidance, but also faced a several lawsuits from shareholders alleging "misrepresentations and omissions" that they say may have artificially inflated the stock price.

And while MAKO has only marginally underperformed the S&P 500 over the past five years, you can bet that many of those angry shareholders are the ones who purchased at the height of the excitement over the past couple of years as the company put up solid system sales numbers, boosted guidance, and announced a promising new total hip arthroplasty solution for its RIO platform:

MAKO Total Return Price data by YCharts.

The stakes are high

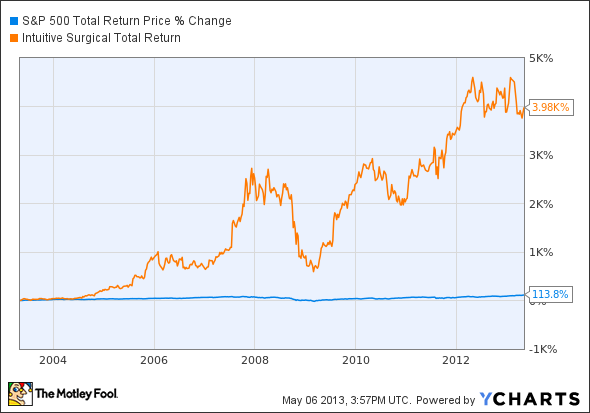

But really, can you blame the market for getting a little overexcited? After all, the meteoric rise of MAKO's soft-tissue cousin Intuitive Surgical is still fresh on investors' minds, and it hasn't gone unnoticed both co-founders of Intuitive Surgical (Dr. Frederic Moll and Dr. John Freund) currently sit on MAKO's board of directors.

Look at what Intuitive did for early investors back then, using very much the same razor-and-blades model that MAKO currently utilizes:

Then again, fellow Fool Dan Carroll did point out recently that MAKO now stands less as an explosive growth opportunity and more as a promising long-term play as the company inches toward profitability.

Sure enough, MAKO had some explaining to do leading up to its most recent quarterly results, so I was relieved when the company provided answers to a few of the burning questions investors had posed, including providing reasonable procedure and system sales guidance, clarification on international opportunities, refreshed monthly utilization numbers, and hints on future new procedure types to expand MAKO's surgery repertoire beyond partial knees and hips.

In addition, MAKO effectively neutralized two of its primary robotic competitors last month with the quick resolution of a pair of disputes, most notably culminating in its purchase of robotic business assets and intellectual property from U.K.-based Stanmore Implants.

What this quarter means

On average this quarter, analysts are expecting MAKO to post revenue of $24.4 million and a loss per share of $0.19. So now that MAKO management finally seems to have effectively aligned expectations with reality, it needs now more than ever to deliver a decent quarter to show investors it knows what the heck it's doing.

Remember, the company is still burning cash as it grows its base of installed systems -- albeit at a continuously slowing rate -- and the high-priced robots can run well into the seven figure range if customers choose to include the $150,000 hip add-on. Needless to say, then, this tends to make overall revenue look chunky even as the number of procedures continues to rise.

If MAKO does manage to meet or exceed expectations, it could easily be off to the the races for shares of this up-and-coming surgical powerhouse. However, if MAKO puts up less-than-satisfying results when it reports tomorrow, renewed fears of a prolonged Hansen Medical-esque decline could easily push the stock to fresh 52-week-lows.

Zero to hero?

Sitting near all-time lows, has MAKO Surgical's robotic surgery growth story rusted over? To help investors answer this question, Fool.com analyst and MAKO expert David Meier has authored a premium research report covering all of the must-know details on the company, including key areas to watch and risks looming in the future for the medical robotics company. Claim your copy by clicking here now.

The article Why This Quarter Is Crucial for MAKO Surgical originally appeared on Fool.com.

Fool contributor Steve Symington owns shares of MAKO Surgical. The Motley Fool recommends Intuitive Surgical and MAKO Surgical. The Motley Fool owns shares of Intuitive Surgical. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.