A Quick Look at Buckeye Partner's First-Quarter Earnings

Petroleum products logistics provider Buckeye Partners is out with its first-quarter earnings. It was a very solid quarter for the MLP with steady performance across its business segments. Let's take a closer look at how the company performed in three areas that I previewed as being the most important to watch.

The numbers

Buckeye beat analysts' expectations by delivering first-quarter income of $89.3 million, or $0.86 a unit, which exceeded the projection of $0.73 a unit. Revenue of $1.34 billion also beat expectations of $1.29 billion. Strong performance at Buckeye's terminal operations along with a big improvement at its energy services segment led to the excellent performance this quarter.

Buckeye reported distributable cash flow of $124.2 million which provided it with a coverage ratio of 1.21 times. This represented a very nice year-over-year increase to distributable cash flow which was $73.6 million last year and represented a coverage ratio just 0.78 times. Better overall business performance and the contribution from its growth projects provided a nice boost to the bottom line. The big news here is that the coverage ratio was high enough this quarter for the company to finally raise its distribution.

The growth

One of the contributing projects this quarter was that Buckeye was able to place 1.6 million barrels of additional storage capacity into service at its BORCO terminal in the Bahamas. The company has been investing heavily to expand capacity at BORCO since acquiring it in 2011. BORCO, which is the crown jewel of its international operations, still has a lot of growth left as the company believes it can nearly double capacity over the coming decade. It's perfectly positioned to benefit from the growth in Latin American crude oil production as well as being an excellent staging areas for ships coming through the soon to be expanded Panama Canal. Continued growth at BORCO, as well as across its platform will be important to drive future distribution growth.

The distribution

This growth is finally being enjoyed by investors. After keeping its distribution flat for five quarters, Buckeye, as I mentioned, announced that it is raising its distribution this quarter. The 1.2% increase will take the distribution from $1.0375-$1.05 per unit. CEO Clark Smith said that "Buckeye's exceptional results over the past three quarters and the positive outlook we have for future periods" are what's driving the distribution increase.

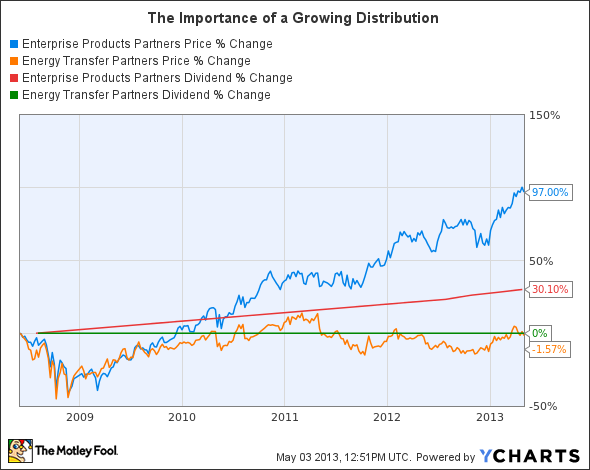

While it might not seem like much of an increase, this is an important first step. Slow and steady distribution increases have a very noticeable impact on the value of the underlying units. Just take a look at this chart of two midstream giants: Enterprise Products Partners and Energy Transfer Partners :

As you can see, Enterprise's distribution has slowly headed higher as the company has consistently raised it for 35 consecutive quarters. This has yielded excellent returns for investors. Meanwhile, Energy Transfer's distribution has been stagnant for the past five years which has also stagnated the returns of unitholders. Again, the chart tells the whole story, so it's welcome news for Buckeye investors to see the distribution heading higher again.

Foolish bottom line

Overall, this was a very solid quarter for Buckeye. Its earnings and cash flow are improving and it's finally raising its distribution. This is exactly the performance I wanted to see after making Buckeye my top MLP to buy last month.

While I like Buckeye a lot, its not my favorite MLP. Instead, I personally prefer Enterprise Products Partners because its superior integrated asset base enables the company to profit by taking on large-scale projects. To learn more about this great company, click here now to check out The Motley Fool's brand-new premium research report on the company.

The article A Quick Look at Buckeye Partner's First-Quarter Earnings originally appeared on Fool.com.

Motley Fool contributor Matt DiLallo owns shares of Enterprise Products Partners L.P. The Motley Fool recommends Enterprise Products Partners L.P. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.