Is Vonage's Stock Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Vonage Holdings fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Vonage's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Vonage's key statistics:

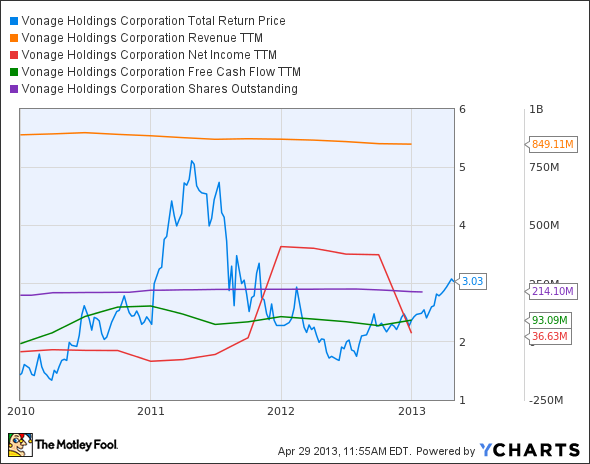

VG Total Return Price data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | (4.5%) | Fail |

Improving profit margin | 205% | Pass |

Free cash flow growth > Net income growth | 1,230.8% vs. 186% | Pass |

Improving EPS | 153.5% | Pass |

Stock growth (+ 15%) < EPS growth | 111.9% vs. 153.5% | Pass |

Source: YCharts. *Period begins at end of Q4 2009.

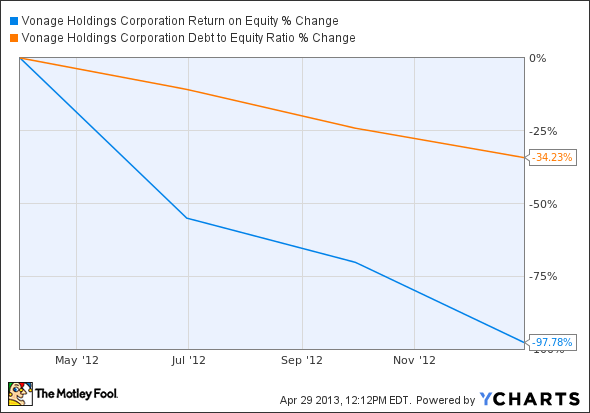

VG Return on Equity data by YCharts.

Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (97.8%) | Fail |

Declining debt to equity | (34.2%) | Pass |

Source: YCharts. *Period begins at end of Q4 2011 due to earlier negative equity.

How we got here and where we're going

Despite a score thrown off by a fairly recent return to positive equity, Vonage appears to be making many good moves to improve its bottom line. The largest concern here lies with the company's declining revenue, but with five out of seven passing grades, Vonage must be doing something right. But is it doing enough to ensure long-term growth and profitability?

In the near term, Vonage has picked up a new CFO, who has the high-finance credentials to continue streamlining the company's balance sheet and income statement. Vonage gave him a pretty sweet pay package, but it could be well worth it if the company actually starts growing again.

The market for Vonage's services, particularly VoIP, is highly competitive, with MagicJack VocalTec also working to drive prices down in the consumer market. Vonage has a few tricks up its sleeve, such as free video calls to in-network subscribers, but given the rather small Vonage user base, this may not be enough to encourage growth. However, Vonage may not need gimmicks to drive growth when its restructuring has already produced real cost savings. Fellow Fool Michael Lewis points out that the company now anticipates another $100 million in annual revenue by 2014 -- not quite enough to push it over 30% cumulative revenue growth for another passing grade, but good enough to get back into positive territory.

Vonage may want to try to move into servicing small businesses, which Fool contributor Rich Duprey notes has been widely adopted by mid-level executives and tech professionals. Of course, this niche is already well-served by 8x8 , but Vonage has over four times as much annual free cash flow as 8x8, which would give it a firmer financial base from which to expand. A recently revealed lobbying plan to free up "premium" area codes for sales nationwide seems to offer another opportunity. Ever wanted to have an elite 212 prefix so that your number makes you seem like a Manhattan financial-district hotshot? Then Vonage's plan might be for you. I'm not so sure most people would find this beneficial, but every little bit of competitive advantage helps in the telecom world.

Putting the pieces together

Today, Vonage has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

It's incredible to think just how much of our digital and technological lives are almost entirely shaped and molded by just a handful of companies. Find out "Who Will Win the War Between the 5 Biggest Tech Stocks?" in The Motley Fool's latest free report, which details the knock-down, drag-out battle being waged by the five kings of tech. Click here to keep reading.

The article Is Vonage's Stock Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.