1 Fertilizer Stock to Buy When Natural Gas Prices Rise

Remember that time when everyone called for indefinitely cheap natural gas? Yeah, scratch that idea -- the cost of futures contracts has doubled from the year-ago period, which is bad news for nitrogen fertilizer companies that purchase their supplies on the spot market. As the most important input for nitrogen fertilizer production, nothing has as big of an effect on the bottom line as natural gas prices. When prices hit 10-year lows in 2012, fertilizer companies captured record profits. Now the trend is abruptly reversing.

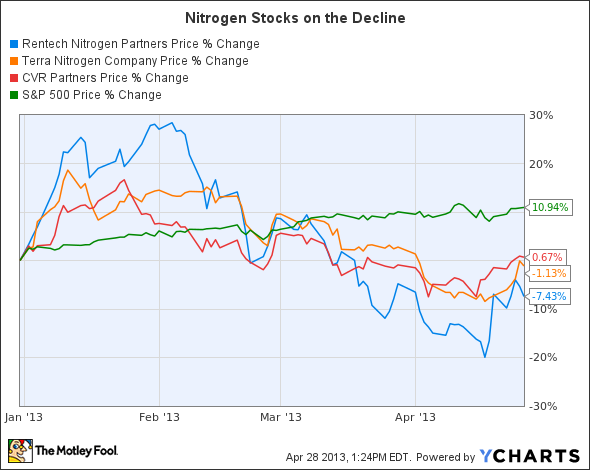

Since many companies in the fertilizer industry are adored for their incredibly high payouts, and those payouts are dictated by the bottom line, investors have good reason to worry. The market has reacted by sending fertilizer stocks down in the first four months of 2013. Should you abandon ship in anticipation of deflating bottom lines and shrinking payouts? If you're looking for high payouts but are wary of rising natural gas prices, there is still one stock you can buy. CVR Partners produces high-priced nitrogen fertilizers without using one iota of natural gas.

Mr. Market is right about this one

Is the market just overreacting? It may be difficult to believe, but profits really could take a nosedive if natural gas continues its upward trend. Consider thatnatural gas represented about 70% of production costs for Terra Nitrogen in 2012. Perhaps more worrisome is the fact that costs of goods sold were 36% higher in 2011 -- when the average price paid for natural gas was almost exactly that of current monthly prices.

Meanwhile, the fine print in the 10-K of Rentech Nitrogen Partners noted that every increase of $0.10 per MMBtu of natural gas increases its production costs by $3.50 per ton of ammonia produced. Natural gas futures have increased by $2.10 per MMBtu since April 2012, which calls for an eye-popping experiment.

That increase means that Rentech's production costs have soared $73.50 per ton in just the last year. What does it mean for the payout? The company can produce roughly 300,000 tons of ammonia per year. An increase of $2.10 per MMBtu would cost Rentech an additional $22 million, or enough to slash the payout by $0.57 per share.

It's not difficult to see why analysts have revised their previously high opinions of Rentech. Rising natural gas prices could offset some of the increase in profits expected from ongoing plant expansions. As a result, shares have underperformed the market by over 18% in 2013 -- far worse than other nitrogen manufacturers.

It should now be pretty clear which industry trend matters most. Can investors escape falling profits by investing in CVR Partners?

The pet coke advantage

Investors who follow CVR Partners are quick to note that its use of pet coke offers a key advantage when it comes to production costs. The company's manufacturing costs are fixed within a relatively tight window and much less volatile than competitors who rely on natural gas. The same cannot be said of Terra Nitrogen and Rentech, but the two will have a leg up on CVR Partners during periods of low natural gas prices. This is exactly what happened last year.

That was overlooked in a recent post by Tim Plaehn of Seeking Alpha, which states that the master limited partnership's feedstock advantage didn't affect the bottom line. By using the period between 2011 and 2012 -- when natural gas prices were at 10-year lows -- Plaehn unintentionally compared Terra Nitrogen's two best years on record to an average year at CVR Partners. It's an apples to oranges comparison.

The advantage of using pet coke isn't that profits will soar, but that they won't fall off the table. Essentially, it is a hedge against volatility. That is often misunderstood by investors.

As long as fertilizer prices remain at healthy levels the company should be able to maintain high profit margins. Given the current shortages of grain worldwide and an increased occurrence of droughts, positive pricing trends should be here to stay. Low natural gas prices may be a thing of the past.

Foolish bottom line

CVR Partners has a relatively limited product lineup and only one facility. In that regard, it is riskier than fellow small nitrogen producers Terra Nitrogen and Rentech. I certainly wouldn't invest too much of my portfolio into the company. However, a new plant expansion came on line in the first quarter that will increase total capacity by nearly 50% and allow for all ammonia to be upgraded to higher-value urea ammonium nitrate.

Oddly, the market has yet to take notice of the expansion. Shares of the company have gone sideways despite the big jump in future earnings that awaits investors. Perhaps the market is pushing it down with its peers, or perhaps investors were spooked by less than stellar annual results stemming from a biannual turnaround late last year. I used the downturn to add to my position and see shares appreciating to a level that more adequately reflects the profitability outlook. Will you be joining me? Let me know in the comments section below.

Worried about lack of diversity? PotashCorp produces all varieties of fertilizer

With less and less arable land available around the world, increasing yields from existing plots could become vitally important to keeping up with expected population growth. Cheap and effective fertilizers could be the key to achieving this goal. As the global leader in potash production, PotashCorp has established several barriers to entry that make it nearly impossible for competition to break through. Click here now to access The Motley Fool's premium research report that covers precisely what these barriers to entry are and details several other key reasons why PotashCorp presents such a compelling investment opportunity today.

The article 1 Fertilizer Stock to Buy When Natural Gas Prices Rise originally appeared on Fool.com.

Motley Fool contributor Maxx Chatsko owns shares of CVR Partners, LP. Check out his personal portfolio, his CAPS page, or follow him on Twitter @BlacknGoldFool to keep up with his writing on energy, bioprocessing, and emerging technologies.The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.