The Struggle for Regional Casinos Continues

The regional gaming market continues to be in a funk, following trends in the rest of the economy. PennNational's first-quarter earnings show progress in some areas and a maddeningly slow recovery in others.

Overall, revenue rose 8% from a year ago to $798.2 million -- just slightly below the company's own guidance. Adjusted EBITDA rose 10% to $220.7 million and net income dropped 17% to $65.3 million, or $0.63 per share.

Growth was driven by the opening of Hollywood Casino Toledo, Hollywood Casino Columbus, and the acquisition of Hollywood Casino St. Louis, so it wasn't organic in nature. The company is planning to build another resort near San Diego and finish an expansion in St. Louis, and is proposing an $807 million project in Massachusetts.

Regional gaming fights for limited dollars

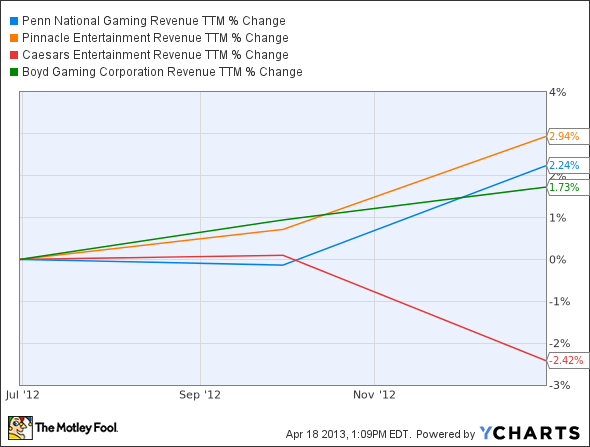

The challenge of growing revenue organically in regional gaming isn't felt by Penn alone. For Caesars Entertainment , a recovery in Las Vegas has been masked by weakness in regional markets, where it still generates a majority of its revenue. Pinnacle Entertainment and Boyd Gaming are also fighting competition, and in Boyd's case, a rapidly declining market in Atlantic City. Over the past year, overall growth has been anemic at these companies.

PENN Revenue TTM data by YCharts.

Instead of seeing the chart above as a sign that growth and returns may not be strong in regional gaming, companies have doubled down. Pinnacle is acquiring Ameristar Casinos, Penn, as I mentioned above, is planning a the resort near San Diego and expanding in St. Louis, and Wynn Resorts and Caesars are fighting over a new license in Boston. For Wynn, this is an effort to expand the brand in a high-profile city, but Caesars has enough trouble with debt and declining revenue in other regional markets. When will the growth of gaming stop?

Nearly every company has plans to expand in one way or another, even as gaming dollars are stretched thin. For investors, this means that return on investment isn't as high, which can be seen in Penn's results today. Higher revenue couldn't mask higher costs, and net income fell, reducing return on investment. Still, the company's plan to spin off a REIT to own its real estate assets should unlock some value, and investors are projected to walk away with a $2.44 dividend. I'm clearly cautious about the regional gaming market, but it's these moves that make Penn National the best breed in this very competitive market.

What is Wynn doing in Boston?

Why exactly does Steve Wynn have his eyes on Boston if regional gaming is struggling? The Motley Fool answers this question and more in our most in-depth Wynn Resorts research available for smart investors like you. Thousands have already claimed their own premium ticker coverage, and you can gain instant access to your own by clicking here now.

The article The Struggle for Regional Casinos Continues originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of Wynn Resorts, Limited. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.