Will Natural Gas Save Exelon Stock in 2013?

With Q1 results around the corner, it's time for investors to size up their stocks. Exelon's shares have risen 23% in the past three months, but does it have what it takes to keep pulling profits? Let's take a look at the utility's finances, fair value, and future to decide whether Exelon stock has what it takes to electrify your earnings.

Nuclear dividends

Investors can't mention Exelon without mentioning nuclear. The utility has bet big on nuclear power, and is the largest nuclear plant owner and operator in the United States. The energy fuels 55% of Exelon's total capacity, followed by 28% from natural gas.

Source: Exelon Investor Relations Website

FirstEnergy is a nuclear runner-up, with four reactors producing nearly one-third of the utility's total energy. But unlike Exelon, FirstEnergy generates around two-thirds of its electricity from coal, with small slices of natural gas, oil, and renewables.

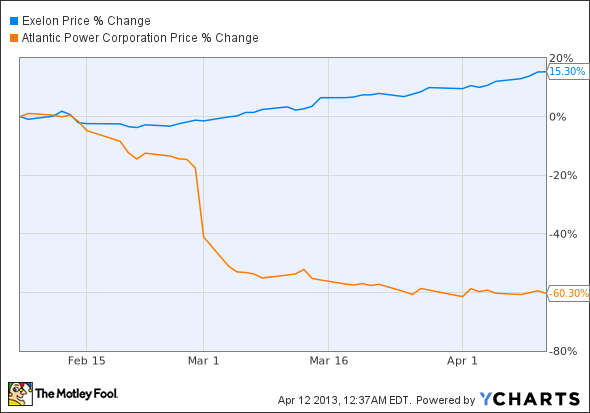

Exelon stock's delicious dividend is what brings most investors to its doorstep, but don't be surprised when its current 6% yield drops to around 3.6% in Q2. The company announced during its last earnings report that it would shave 40% off its dividend to keep its balance sheet strong and investor-friendly and clear up funds for new growth opportunities. I'm inclined to agree with Exelon's decision to cut its oversized dividend and, if Exelon stock returns are any indicator, Wall Street also gave the utility its seal of approval.

Atlantic Power also announced a dividend haircut this past quarter, but it may have been too little, too late. With bad books and a floundering generation fleet, Mr. Market put Atlantic's stock out to pasture after its March 1 report.

Valuation station

Exelon stock was beaten down worse than most during the Great Recession, but a recent comeback has some investors wondering whether its stock will excel in the coming years. The company's debt and margins are in line with industry and its newly sustainable dividend makes financial sense. The company's 25.7 P/E ratio hits the top 10% of utilities, but its price-to-sales and price-to-book values remain reasonable.

Natural matters

What will ultimately determine Exelon's profitability is, you guessed it, natural gas prices. Luckily, a new report (link opens in PDF) from the Energy Information Administration points to new highs for natural gas prices over the next couple years.

Coal is expected to benefit the most, with demand jumping 7.8% for 2013. That'll provide a welcome burst of energy to coal-centric TECO Energy , but nuclear should also emerge ahead for 2013.

As nuclear plants churns out a steady 2.1 million MWH per day, Henry Hub natural gas prices are expected to jump 28% in 2013 to $2.75 per MMBtu, followed by an additional 2.2% bump in 2014.

As natural gas prices jump and the nation moves increasingly toward clean energy, Exelon is perfectly positioned to capitalize on having the largest nuclear fleet in North America. This strength, combined with an increased focus on balance sheet health and its recent merger with Constellation, places Exelon and its resized dividend on a short list of the top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

The article Will Natural Gas Save Exelon Stock in 2013? originally appeared on Fool.com.

Motley Fool contributor Justin Loiseau has no position in any stocks mentioned, but he does use electricity. You can follow him on Twitter, @TMFJLo, and on Motley Fool CAPS, @TMFJLo.The Motley Fool recommends Exelon. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.