Stock News: Energy Edition

Headlines have always been instrumental in the process of disseminating news to readers. In today's world of Internet consumption and clickability, they have become even more important to organizations competing for views. Sometimes our visceral reaction to a headline shapes the way we interpret the content that follows, regardless of what it actually means -- if it means anything at all. It is important for investors to stay grounded and not let headlines color our interpretation of important information. Today, I'll look at three current energy headlines and attempt to separate the signal from the noise.

Ripped from the headlines

We'll get started with the classic upgrade or downgrade of a stock news. We have this note on a master limited partnership from Zacks.com:

If you are a unitholder in Energy Transfer Partners , you might not even click on this article. A simple fist pump, and you're moving on. But these short pieces can clue you in to what other people are thinking about your investment, potential changes you may need to make to your investment thesis, and how credible the stock-rating organization is.

In this case, Zack's is upgrading Energy Transfer based on its fourth-quarter results and the partnership's announcement to buy out the remaining stake in ETP Holdco. The post doesn't mention any potential downside, nor does it address risk, so if you aren't already a unitholder, there is clearly not enough information here to make an investment decision. The news that someone thinks it is a buy right now may give you warm feelings about a stock, but make sure you put in the research time before you pick up shares.

Now let's move on to articles about movements in oil prices, because those come out basically every day:

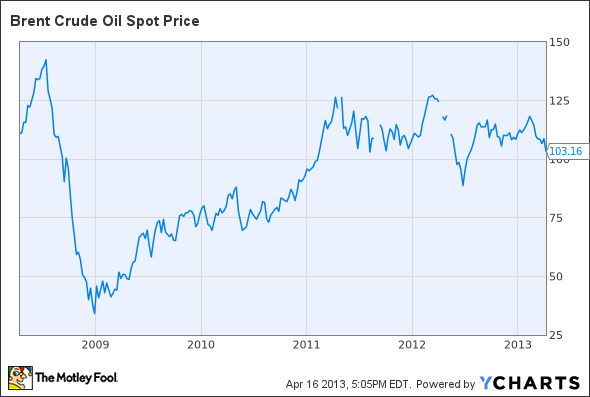

For whatever reason, every time the price of oil rises and falls -- regardless of the gravity of change -- it counts as news. This is as good a time as any to look at the five-year price movements for Brent crude:

Source: Brent Crude Oil Spot Price data by YCharts.

Through a series of almost daily up and down movements, Brent crude has slowly risen over the last four years. The day-to-day change in price is immaterial; it makes more sense to know what prolonged high or low oil prices mean for your stocks.

For that, you'll want to check out comparisons of a variety of different energy stocks and whether they do or do not track the Brent and WTI oil movements. Midstream companies like Enterprise Products Partners march to the beat of their own drum, while independent oil and gas companies like Canadian Natural Resources track the price of black gold a bit closer. Year to date, Enterprise is up 20%, Canadian Natural Resources is up just shy of 2%, and the price of Brent has fallen about 7%.

Last but not least, we have the now-ubiquitous news headline about energy independence:

This brings up a lesson I need to learn myself, as I often begin to build arguments refuting articles about energy independence before I have even read them. It is impossible to be energy independent, my thinking goes, while we remain so dependent on oil.

This particular article is different from the rest because it has a caveat in the headline. As we read further along, we come across a couple of other points that set this piece apart from many others. First, the article acknowledges that U.S. energy production is increasing, but that its effect on American energy self-sufficiency is debatable.

Next, you have this statement from an Energy Information Administration analyst: "If you change assumptions about key factors, it can have a very significant impact on the long term projections." This alone goes a long way in demonstrating that this agency, which many investors depend on for data, is developing its ideas and acknowledging there are multiple outcomes for our energy situation right now. Compare that to a site that preaches one idea and one idea only, and you see what I'm getting at. There is perhaps nothing more important in interpreting stock news than recognizing which sources provide value and which do not.

Foolish bottom line

We're facing the greatest likelihood of change to our energy systems since the industrial revolution. As a result, while we can ignore many headlines, we shouldn't ignore them all. Evaluating the real meaning behind energy news stories takes time, but it will be worth it.

It's easy to forget the necessity of midstream operators that seamlessly transport oil and gas throughout the United States. Kinder Morgan is one of these operators, and one that investors should commit to memory due to its sheer size - it's the fourth largest energy company in the U.S. - not to mention its enormous potential for profits. In The Motley Fool's premium research report on Kinder Morgan, we break down the company's growing opportunity -- as well as the risks to watch out for -- in order to uncover whether it's a buy or a sell. To determine whether this dividend giant is right for your portfolio, simply click here now to claim your copy of this invaluable investor's resource.

The article Stock News: Energy Edition originally appeared on Fool.com.

Fool contributor Aimee Duffy has no position in any stocks mentioned. If you have the energy, follow her on Twitter where she goes by @TMFDuffy.The Motley Fool recommends Enterprise Products Partners. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.