Is Terra Nitrogen's Stock Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Terra Nitrogen fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Terra's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Terra's key statistics:

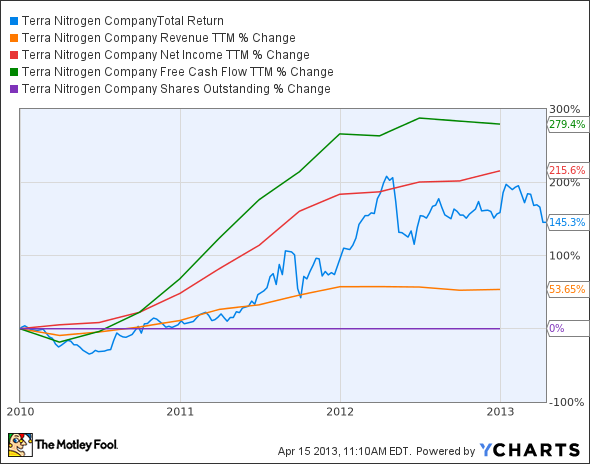

TNH Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 53.7% | Pass |

Improving profit margin | 79.3% | Pass |

Free cash flow growth > Net income growth | 279.4% vs. 215.6% | Pass |

Improving EPS | 215.9% | Pass |

Stock growth (+ 15%) < EPS growth | 145.3% vs. 215.9% | Pass |

Source: YCharts.

* Period begins at end of Q4 2009.

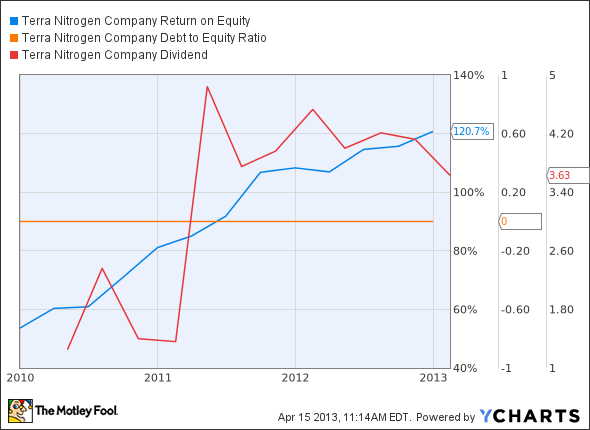

TNH Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 125.2% | Pass |

Declining debt to equity | No debt | Pass |

Dividend growth > 25% | 190.4% | Pass |

Free cash flow payout ratio < 100%** | 106.3% | Fail |

Source: YCharts and Morningstar.

* Period begins at end of Q4 2009.

** 100% used due to MLP structure requiring 90% earnings payout.

How we got here and where we're going

Terra very narrowly misses out on a perfect nine out of nine passing grades. Had we analyzed the company a year ago, it might well have passed -- Terra's dividend payouts were lower than its free cash flow in 2011. And those dividend payouts have been huge and hugely attractive, as the company hasn't financed its payout with debt at all despite maintaining a yield in excess of 7% for years. Terra's already achieved greatness for early shareholders, but is it destined for more? Let's take a look.

As a publicly traded subsidiary of fertilizer maker CF Industries , Terra gets beneficial access to the natural gas feedstock available to its parent. Since both companies operate on similar manufacturing models, we can also use CF as a gauge of Terra's potential. This year, CF is improving -- especially on the bottom line. Its earnings per share grew 30% year-over-year as of its most recent report, thanks almost entirely to the plummeting costs of natural gas. The problem Terra faces is that it's less able to adapt to changing market trends than its larger parent. Natural gas prices are pretty much the end-all for Terra, although higher capital expenditures and production agreements with CF can impact the MLP's ultimate profitability. Where are natural gas prices going? It sure looks like the wrong direction, as far as Terra's profitability is concerned:

Henry Hub Natural Gas Spot Price data by YCharts.

That's not a good trend for nitrogen-using fertilizer makers. We've already seen some indication that steady profit growth may be ending, as fellow nitrogen fertilizer MLP CVR Partnersreported results virtually identical to last year's, instead of enjoying strong growth as it has in the past. The one thing in these companies' favor is the simple fact that farmers need fertilizer, now perhaps more than ever in light of persistent droughts that are making every alternative to watering more valuable. That can help maintain Terra's profitability in the face of rising input prices, but for how long? Farmers can only bend so far before their finances break.

Putting the pieces together

Today, Terra has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

What macro trend was Warren Buffett referring to when he said "this is the tapeworm that's eating at American competitiveness"? Find out in our free report: What's Really Eating at America's Competitiveness. You'll also discover an idea to profit as companies work to eradicate this efficiency-sucking tapeworm. Just click here for free, immediate access.

Keep track of Terra by adding it to your free stock Watchlist.

The article Is Terra Nitrogen's Stock Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter, @TMFBiggles, for more insight into markets, history, and technology.The Motley Fool owns shares of CF Industries Holdings. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.