China Takes a Bite out of Wall Street

There's a lot of red ink on Wall Street today after China took a bite out of the market's enthusiasm. The world's second-largest economy said GDP rose 7.7% in the first quarter, slowing from 7.9% in Q4 and falling short of economists' 8% estimate. Growth in China has helped drive global demand as the U.S. and Europe fight off economic struggles, so investors are more than a little concerned about the news. The Dow Jones Industrial Average sold off 1.19% as a result of the news, while the S&P500 is down 1.73% today.

Caterpillar is taking the biggest hit on the Dow, crashing 3.1% today. The company relies on growth in emerging markets to grow sales, and China's GDP numbers will always affect the stock in the short term. A lot of this weakness is already priced into the stock, so it may not be bad for long-term investors. The company reports earnings next Monday, and estimates call for $1.44 per share in earnings, down from $2.37 a year ago.

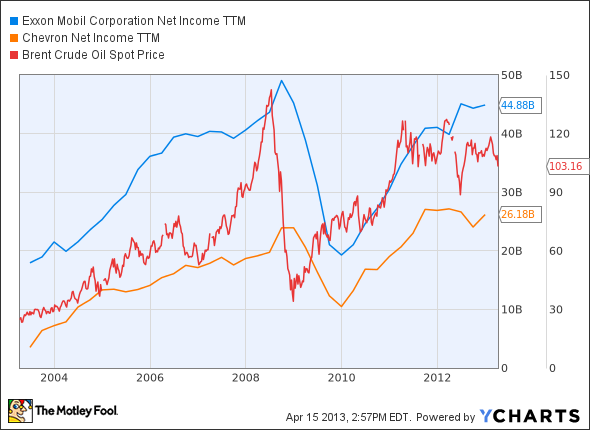

If you thought stocks were getting hit hard today, you need to take a look at the commodities market. Gold is down 9.6% as I write, silver has fallen 12.9%, and oil is down 2.7% to less than $89 per barrel. This drop has hit oil giants Chevron and ExxonMobil , who are down 2.5% and 2.3%, respectively. You can see in the chart below that a drop in oil's price may impact earnings at both companies, but it'll have to be a lot more severe than $2 per barrel.

XOM Net Income TTM data by YCharts.

Economic weakness in the U.S. and Europe and a slowdown in China may lead to a drop in the price of oil, but it will only be temporary. Investors with a long-term view can pick up highly profitable companies like ExxonMobil and Chevron on these drops, because these supermajors can generate a strong profit no matter what oil does.

If you're on the lookout for some intriguing energy plays, check out The Motley Fool's "3 Stocks for $100 Oil." For free access to this special report, simply click here now.

The article China Takes a Bite out of Wall Street originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.