2 Brilliant Blue-Chip Dividend Stocks You Can Buy Today

The Dow Jones Industrial Average is not just a collection of 30 market-defining blue chips. It's also packed with brilliant dividend stocks.

All 30 of the current components pay a dividend today, ranging from Bank of America' modest 0.3% yield (with a bullet, now that regulators have finally given the bank the option to raise payouts again) to AT&T and its massive 4.7% yield backed by monthly payments from more than 100 million wireless customers.

The average Dow stock sports a 2.6% dividend yield and has increased payouts by 8.7% annually over the last decade. As a testament to the Dow's dividend strength, that long-term growth includes the banking industry's blanket cuts after the 2008 meltdown. For another perspective on the Dow's dividend powers, consider that about half of the 2,800 stocks in the Russell 3000 index index don't pay dividends at all. The average yield on that wider market barometer is also 2.6%, but payouts grow at a far slower 6% annual rate.

So which of these 30 potential income machines can you buy today? The recent slump in the tech sector has slapped huge value tags on two of the Dow's Silicon Valley residents.

The widely covered death of the PC has caused investors to treat Intel like toxic sludge. Share prices have fallen 24% over the last year while the Dow advanced 14.2% overall, pushing Intel's dividend yield into the stratosphere. The chip giant has never before been the brilliant dividend stock that it is right now.

INTC P/E Ratio TTM data by YCharts.

This dividend is so tasty, I had to buy some for myself. I locked in an effective 4.4% yield in early December 2012, and you can still nab a 4.2% yield today.

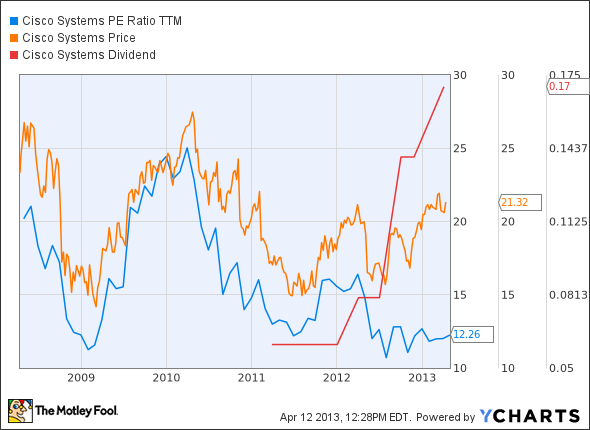

Cisco Systems hasn't suffered along with Intel in the PC panic, because the company works far closer to enterprise-class computing needs. But share price gains haven't kept up with recent earnings improvements, and while the dividend policy may be young, it has already been boosted three times.

CSCO P/E Ratio TTM data by YCharts.

This adds up to a generous 3.2% yield right now, with every indication that Cisco plans to take the payouts even higher.

The Dow is an embarrassment of riches. Intel and Cisco are the two best combinations of deep value and excellent dividend stocks I can find there today.

When it comes to dominating markets, it doesn't get much better than Intel's position in the PC microprocessor arena. However, that market is maturing, and Intel must find new avenues for growth. In this premium research report on Intel, our analyst runs through all of the key topics investors should understand about the chip giant. Click here now to learn more.

The article 2 Brilliant Blue-Chip Dividend Stocks You Can Buy Today originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Intel, but he holds no other position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+. The Motley Fool owns shares of Bank of America, Cisco Systems, and Intel. Motley Fool newsletter services have recommended buying shares of Cisco Systems and Intel. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.