Refiners Were the Market's Winners Today

Oil prices were on the move today after a weaker-than-expected unemployment report stoked fears of a slowdown in the U.S. economy. At 5:00 pm EDT on Thursday, Brent crude was down 0.62%, to $106.31, and WTI crude was down 1.26%, to $93.35. U.S. natural gas was up 1.49%, to $3.96.

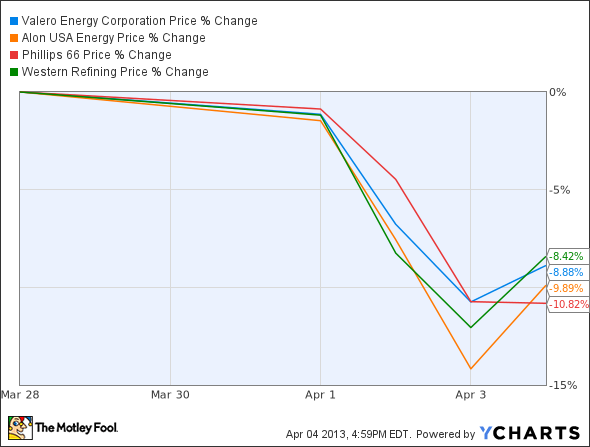

Today's oil and gas stocks leaders were all refiners. Last Friday, the EPA announced new rules for gasoline that include a 67% reduction in sulfur in an effort to improve air quality. On Tuesday, the sector was crushed after a spokesman for Valero said the company expected the new EPA rules for gasoline would cost it $300-$400 million over the next few years. That announcement sent the stock down 6% on Tuesday, and the sector as a whole fell with it. The decline continued yesterday, as the market was also down.

Today, refiners as a whole were up as investors took advantage of the drops in prices.

Among companies with over a $1 billion market cap, today's oil and gas stocks leader was Alon USA Energy , up 4.95% to $17.16. During the refiners' drop on Tuesday and Wednesday, Alon dropped 12.89%. Despite the comeback today, the stock is still down 8.6% from where it was before the plunge. Alon USA owns refineries in Louisiana and California, 11 asphalt terminals, as well as 300 7-11 retail locations. The company has been profiting heavily from the massive price difference between WTI and Brent crude. In November of 2012, the company IPO'd its Big Springs refinery as a master limited partnership, Alon USA Partners LP, the proceeds of which Alon used to pay down debt.

Second among oil and gas stocks today was Delek U.S. Holdings up 4.78%, to $37.28. During the refiners' drop on Tuesday and Wednesday, Delek dropped 9.88%. Despite the comeback today, the stock is still down 5.6% from where it was before the plunge. The company owns two refineries in Texas, terminals throughout Texas, Arkansas, and Tennessee, and retail stores throughout Tennessee, Alabama, and Georgia.

Third among oil and gas stocks today was Western Refining up 4.14%, to $32.43. During the refiners' drop on Tuesday and Wednesday, Delek dropped 11%. Despite the comeback today, the stock is still down 7.32% from where it was before the plunge. Last month, after crushing its earnings, Western Refining announced they were considering launching a master limited partnership for some of their midstream assets. MLP spinoffs have been a hot topic the past year as more and more companies take advantage of investors' hunt for yield, and the tax savings MLPs offer. Fool senior analyst Jim Mueller added to his holdings of Western Refining in February at prices slightly higher than today -- find out why by reading his pitch here.

Foolish bottom line

It's easy to forget the necessity of midstream operators that seamlessly transport oil and gas throughout the United States. Kinder Morgan is one of these operators, and one that investors should commit to memory due to its sheer size - it's the fourth largest energy company in the U.S. - not to mention its enormous potential for profits. In The Motley Fool's premium research report on Kinder Morgan, we break down the company's growing opportunity - as well as the risks to watch out for - in order to uncover whether it's a buy or a sell. To determine whether this dividend giant is right for your portfolio, simply click here now to claim your copy of this invaluable investor's resource.

The article Refiners Were the Market's Winners Today originally appeared on Fool.com.

Fool contributor Dan Dzombakcan be found on Twitter @DanDzombakor on his Facebook page,DanDzombak. Hehas no position in any stocks mentioned. The Motley Fool owns shares of Western Refining. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.