3 Buy-Now Stocks From the "World's Greatest Growth Portfolio"

In Dec. 2011, I attempted to help out family and friends by creating what I considered an ideal growth portfolio.

If, during 2012, you had invested in the S&P 500, your investment would have returned 15.9%, after factoring in dividends. That's actually outstanding. And yet, had you been invested in the "World's Greatest Growth Portfolio," you would have trounced the S&P 500, earning a 26.5% return on your investment.

Before 2013 began, I decided to review all of the companies to see which ones still made the cut and which didn't. Since inception, if you had invested $10,000 in this portfolio, it would now be worth $12,800 -- or $200 more than if it had been invested in the S&P 500.

Each month, I check over all 13 stocks in this portfolio and pick three that are particularly intriguing. That's why I call them "Buy Now" stocks. Read below to see what those three stocks are, and at the end, I'll offer up access to a special premium report on one portfolio stock that's taken a beating lately.

Core Company | Allocation | Jan. 1 Balance | Current Balance | Change |

11.5% | $115.00 | $100.63 | -12.5% | |

11.5% | $115.00 | $129.03 | 12.2% | |

11.5% | $115.00 | $122.13 | 6.2% | |

11.5% | $115.00 | $109.71 | -4.6% | |

Tier One | ||||

7.5% | $75.25 | $80.14 | 6.5% | |

7.5% | $75.25 | $62.98 | -16.3% | |

7.5% | $75.25 | $75.33 | 0.1% | |

7.5% | $75.25 | $75.02 | -0.3% | |

Tier Two | ||||

5% | $50.00 | $45.35 | -9.3% | |

5% | $50.00 | $76.65 | 53.3% | |

5% | $50.00 | $46.35 | -7.3% | |

5% | $50.00 | $55.25 | 10.5% | |

5% | $50.00 | $40.90 | -18.2% | |

Year to Date | $1,000.00 | $1,019.47 | 1.2% | |

Source: Fool.com.

LinkedIn

I figured I would start out with the one that would leave readers scratching their heads. LinkedIn currently sells for 900 times earnings, and its stock has appreciated 175% since the beginning of 2012. Surely, this stock is due for a serious pullback, right?

Well, in the short term, it's quite possible. And to be honest, that pullback could be significant. Then again, trying to predict short-term movements is a losing battle, and I think the long-term path of this company looks great.

Contrary to popular opinion, LinkedIn only makes a slice of its money from advertising. Instead, it caters more toward individuals looking to get a job and companies looking for qualified employees. If it were to reach the height of its potential, LinkedIn could completely rewrite the human resources division of large and small businesses alike.

And the company's recent past shows that its model is catching on.

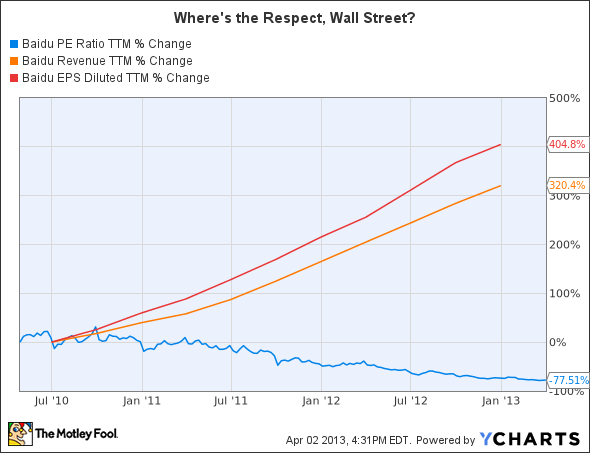

Source: LinkedIn. All numbers in millions. Talent Solutions comes from companies, Premium Subscriptions from individuals, and Market Solutions from advertisers.

Baidu

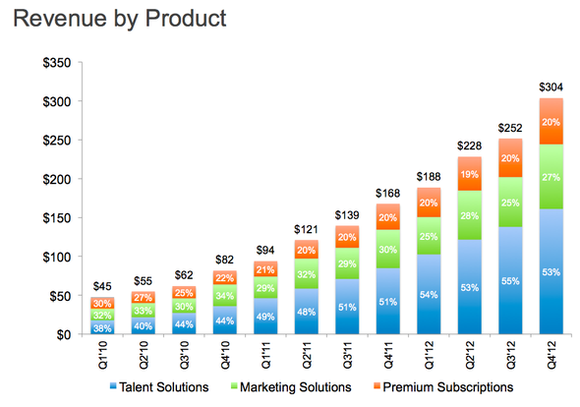

There are a lot of reasons that Baidu has been knocked down lately: It's located in China, a place that's been known for stock frauds; it is facing increased competition; growth at Baidu and China in general is starting to slow.

But the fact remains that there's been no signs of fraud from the company, and competition and slowed growth are hardly enough to explain how the stock for China's largest search engine is now trading for its lowest multiple ever, despite having grown revenue and earnings at impressive rates. Sooner or later, something's got to give.

Source: BIDU P/E Ratio TTM data by YCharts.

3D Systems

It's been a tough couple of months for investors in this 3-D printing company, whose shares have fallen more than 30% since late January.

Unlike rival Stratasys, which released earnings that Wall Street generally applauded and focuses more intensely on meeting the 3-D printing needs of businesses, 3D Systems' numbers and focus on consumers have gotten some worried.

But the fact of the matter is that this is a growth portfolio, where it's OK to place some big bets. The future of 3-D printing could be huge. And with 3D Systems now trading for just 25 times expected earnings, now is as good a time as any to buy a starter position.

Are stories of this demise greatly exaggerated?

You might notice that I left Intuitive Surgical off my list, even though the stock has dropped 15% since mid-February. That's because the president of a leading medical organization has called the usefulness of the company's daVinci Surgical Robot into question. For the time being, I'm sitting on my shares.

However, Intuitive Surgical expert Karl Thiel believes a visible path to long-term growth persists. Will Intuitive capitalize or will it be crushed by unforeseen pitfalls? His report highlights all of the key opportunities and risks facing the company -- and includes a full year of ongoing updates as key new hits -- so be sure to claim your copy by clicking here now.

The article 3 Buy-Now Stocks From the "World's Greatest Growth Portfolio" originally appeared on Fool.com.

Fool contributor Brian Stoffel owns shares of Apple, Google, Amazon.com, LinkedIn, Starbucks, Baidu, Whole Foods Market, lululemon athletica, Intuitive Surgical, Westport Innovations, Stratasys, and IPG Photonics. The Motley Fool recommends 3D Systems, Amazon.com, Apple, Baidu, Google, Intuitive Surgical, IPG Photonics, LinkedIn, Lululemon Athletica, Starbucks, Stratasys, Westport Innovations, and Whole Foods Market. It owns shares of 3D Systems, Amazon.com, Apple, Baidu, Google, Intuitive Surgical, IPG Photonics, LinkedIn, Starbucks, Stratasys, Westport Innovations, and Whole Foods Market and has the following options: short Jan. 2014 $36 calls on 3D Systems and short Jan. 2014 $20 puts on 3D Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.