Is Southern Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Southern fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Southern's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Southern's key statistics:

SO Total Return Price data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 5% | Fail |

Improving profit margin | 46% | Pass |

Free cash flow growth > Net income growth | 106.9% vs. 43% | Pass |

Improving EPS | 29.6% | Pass |

Stock growth (+ 15%) < EPS growth | 61.8% vs. 29.6% | Fail |

Source: YCharts.

*Period begins at end of Q4 2009.

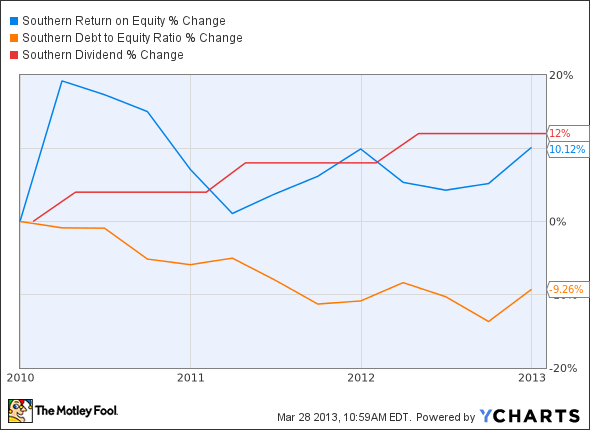

SO Return on Equity data by YCharts.

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 10.1% | Pass |

Declining debt to equity | (9.3%) | Pass |

Dividend growth > 25% | 12% | Fail |

Free cash flow payout ratio < 50% | 1,902% | Fail |

Source: YCharts.

*Period begins at end of Q4 2009.

How we got here and where we're going

Five out of nine passing grades isn't a bad showing, but it is a bit disturbing to see such a well-established company's share price running away from its fundamental growth. More distressing is Southern's unsustainably high level of dividend payouts relative to free cash flow, which has languished below earnings for many years -- as you might expect for such a capital-intensive enterprise.

Southern's in the process of transitioning toward more gas and nuclear power generation, which will understandably keep capital costs high for at least next several quarters. However, as my fellow Fool Justin Loiseau points out, Southern is hardly alone in overextending itself on dividend payments recently. Of its larger peers, only Exelon is paying out a comparatively reasonable amount of free cash flow in dividends -- many utilities fell into negative free cash flow territory in 2012. Utilities have generally been a very mixed bag on a fundamental basis. Not only are they struggling to maintain positive free cash flow, but the only way anyone seems able to grow revenue is by merger, as Duke Energy and Exelon both went through the process last year.

On a more positive note, Southern is doing better than nearly every other utility (except Exelon) at reducing its debt levels relative to equity:

SO Debt to Equity Ratio data by YCharts.

NextEra Energy might be the world's most admired utility, but its financial management hasn't been quite as admirable as Southern's. Duke and Dominion Resources have both taken on a substantial amount of new debt over the past three years as well, which could leave them more susceptible to dividend cuts (as if they weren't already), should a major natural disaster strike again with the destructive force of last year's Hurricane Sandy.

Southern may not be perfect, but it's doing the best it can with a rather limited hand in utility power generation. However, after having yield-seeking investors flock to utility stability for years, the stock may be a bit overheated. Will it be worth investing more over the near term, or does a better entry point wait later this year, or next?

Putting the pieces together

Today, Southern has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

As the nation moves increasingly toward clean energy, Exelon is perfectly positioned to capitalize on having the largest nuclear fleet in North America. This strength, combined with an increased focus on balance sheet health and its recent merger with Constellation, places Exelon and its resized dividend on a short list of the top utilities. To determine if Exelon is a good long-term fit for your portfolio, you're invited to check out The Motley Fool's premium research report on the company. Simply click here now for instant access.

Keep track of Southern Company by adding it to your free stock Watchlist.

The article Is Southern Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter, @TMFBiggles, for more insight into markets, history, and technology.The Motley Fool recommends Dominion Resources, Exelon, and Southern. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.