How Dividends Change the Game for Microsoft Investors

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

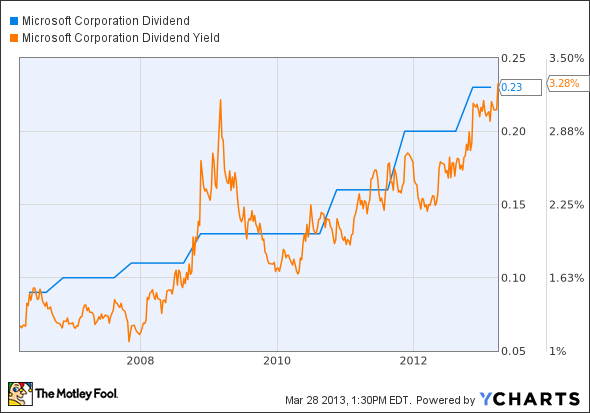

Microsoft doesn't have decades of dividend history to fall back on, but the company is a quick learner. Microsoft has increased its regular dividends every year since the first payout policy was implemented, save for a brief one-year pause triggered by the economic crisis of 2008. Share prices haven't exactly soared, but dividend yields are growing nicely:

MSFT Dividend data by YCharts.

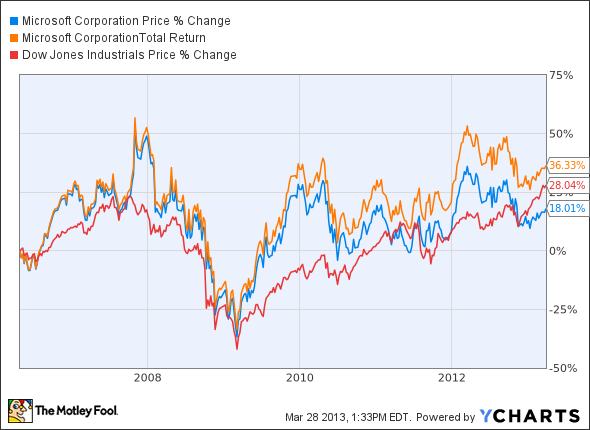

Without dividend payments, the stock would have lagged its Dow Jones peers significantly. But the race becomes much closer if you reinvested Microsoft's dividend checks along the way. If not for the disappointing launch of Windows 8 last year, shareholders would have kept up with the blue-chip index over the last seven years.

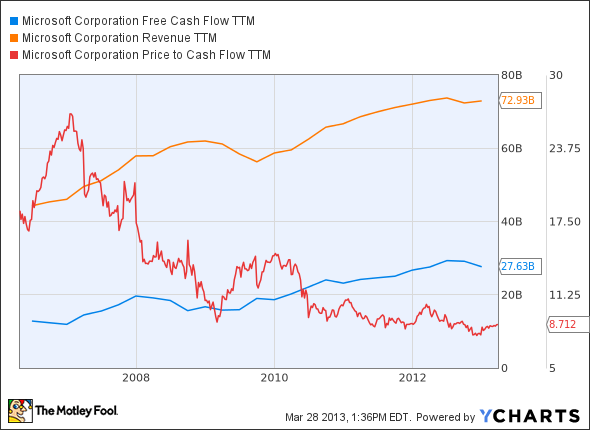

Mind you, it's not like Redmond is falling apart at the seams. That squiggly stock chart goes along with fairly impressive increases in long-term sales and cash flows. It's the price-to-cash-flow ratio that has declined, not the business results themselves.

MSFT Free Cash Flow TTM data by YCharts.

The company has plenty of headroom to become an even more attractive dividend play. Microsoft paid out $7 billion to shareholders last year but collected $27.6 billion in free cash. Nobody is asking Redmond to pour buckets of cash into its dividend policy, but the option is there if management wanted to appeal to a new class of investors.

As it stands, only seven of the Dow's 30 blue chips offer a stronger yield than Microsoft. That pecking order might not last forever if Redmond sticks with its generous cash-sharing policies -- or takes the next step with even stronger dividend increases.

It's been a frustrating path for Microsoft investors, who have watched the company fail to capitalize on the incredible growth in mobile over the past decade. However, Microsoft is looking to make a splash in this booming market. In this brand-new premium report on Microsoft, our analyst explains that while the opportunity is huge, the challenges are many. He's also providing regular updates as key events occur, so be sure to claim a copy of this report now by clicking here.

The article How Dividends Change the Game for Microsoft Investors originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.Motley Fool newsletter services have recommended buying shares of Microsoft. The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.