How Dividends Change the Game for Caterpillar Investors

The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

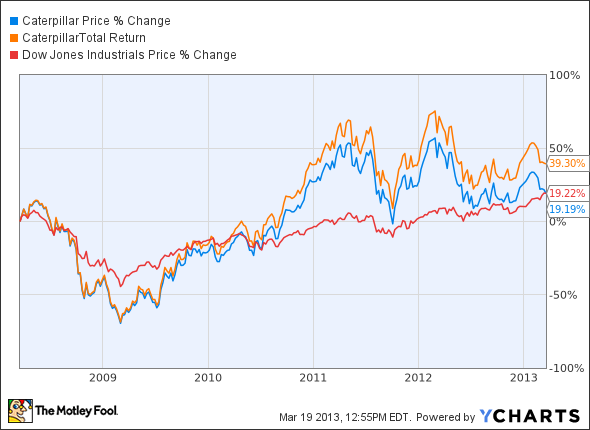

Today, I'll take a look at construction machinery veteran Caterpillar . The stock is generally a good proxy for the global economy, given Caterpillar's deep ties with infrastructure and housing improvements. It does swing up and down with more gusto than the Dow Jones Industrial Average , which has counted Caterpillar as a member since 1991. In the long run, the volatility has worked out in Caterpillar's favor.

A generous dividend policy has poured gravy on top of Caterpillar's already impressive share price returns:

Caterpillar has more than tripled over the last decade -- or quadrupled if you faithfully bought more shares with every dividend check. That's a 40% increase in total returns, compared with a 16% dividend effect on the Dow as a whole.

Some dividend kings rest their shareholder value on rock-steady payout increases over the years. Caterpillar's story is a bit different.

Caterpillar took the crisis of 2008 and 2009 particularly hard, because construction activity ground to a halt on a global level. The stock lost 73% of its value between April 2008 and the bottom in March, 2009. But unlike the financial giants that stumbled on a similar scale, Caterpillar never slashed its dividends. You see, it's torrential cash flows never stopped gushing, even at the worst of times. Maintaining the dividend was a no-brainer.

So faithful shareholders ended up buying a lot of stock with their stable dividends. If you bought in at the right time, you could have locked in an effective yield of 7.2%.

It's not the traditional dividend story of rapid payout boosts, but rather one of unshakable cash-building power in the face of global disaster. There's nothing wrong with taking that alternative road to dividend riches.

Caterpillar is the market share leader in an industry in which size matters, and its quality products, extensive service network, and unparalleled brand strength combine to give it solid competitive advantages. Read all about Caterpillar's strengths and weaknesses in The Motley Fool's brand-new report. Just click here to access it now.

The article How Dividends Change the Game for Caterpillar Investors originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.