Does HP's Big Jump Today Make Sense?

Hewlett-Packard swims against the market currents today. The stock jumped as much as 3.2% overnight, while the Dow Jones Industrial Average has traded in the red all day. HP is the Dow's largest gainer today by a wide margin, adding more than five points to the index's value.

HP's big jump rests on an upgrade from major analyst house Morgan Stanley. Star analyst Katy Huberty raised her view on the stock from "neutral weight" to "overweight," or what most would call an upgrade from "hold" to "buy." Her price target sits at $27 per share, which is a 22% premium to Friday's closing price.

What's behind this upgrade? Faster cash flows, mostly.

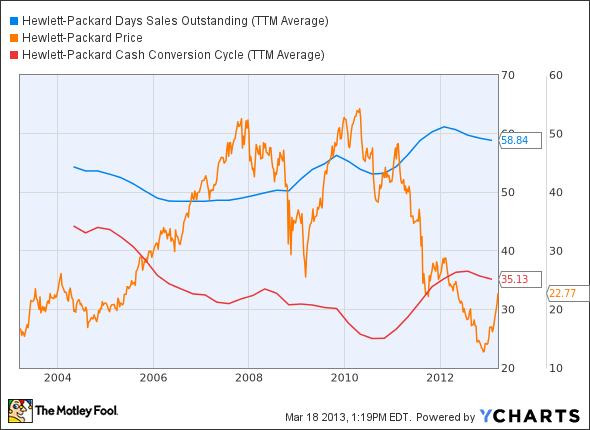

Huberty believes HP's payroll cuts will help the company convert inventories into cash sales faster than expected. The cash conversion cycle should shorten to 23 days by the end of the year -- and maybe as low as 20 days if the business improvements continue. These would be drastic improvements from HP's current situation.

HPQ Days Sales Outstanding data by YCharts.

Huberty sets her valuation targets for HP by comparing its expected cash flows to those of computing rival Dell , which is trading at low multiples despite a brewing buyout. Both companies face the same massive headwinds, so it makes sense to apply similar cash-flow multiples. In other words, Huberty's $27 price target is based on some fairly pessimistic assumptions.

So I can understand why traders are all over HP today. A big analyst name makes a compelling case for shares rising far higher -- that is, as long as you believe in Huberty's assumptions.

I'm not at all sure that HP's cost-cutting moves will result in stronger cash-conversion cycles, because demand for the company's products is falling through the floor. HP's traditional PC systems are becoming obsolete as tablets and smartphones start to do many of the jobs a desktop used to handle, so the overall market is shrinking. Gaining market share in a dying sector doesn't exactly scream "Buy!" to me.

So I'd take Huberty's report with a large grain of salt. I need CEO Meg Whitman to make drastic changes to her business strategy, because the fine-tuning we've seen so far isn't likely to help much. This upgrade did nothing to change my bearish CAPScall on HP.

The massive wave of mobile computing has done much to unseat the major players in the PC market, including venerable technology names like Hewlett-Packard. However, HP is rapidly shifting its strategy under the new leadership of CEO Meg Whitman. But does this make HP one of the least-appreciated turnaround stories on the market, or is this a minor detour on its road to irrelevance? The Motley Fool's technology analyst details exactly what investors need to know about HP in our new premium research report. Just click here now to get your copy today.

The article Does HP's Big Jump Today Make Sense? originally appeared on Fool.com.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders' bio and holdings or follow him on Twitter and Google+.The Motley Fool has a disclosure policy. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. Try any of our Foolish newsletter services free for 30 days.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.