Hewlett-Packard Leads the Dow to New Highs

The Dow Jones Industrial Average is up after for the 10th day in a row following multiple positive reports on the state of the economy. As of 1:15 p.m. EDT the Dow was up 59 points, or 0.41%, to 14,515. The S&P 500 was up 0.4% to 1,561.

There were three U.S. economic releases today.

Report | Period | Result | Previous |

|---|---|---|---|

Weekly new unemployment claims | March 2 to March 9 | 332,000 | 342,000 |

Producer price index | February | 0.7% | 0.2% |

Core PPI | February | 0.2% | 0.2% |

Current account deficit | Q4 | ($110 billion) | ($112 billion) |

Source: MarketWatch U.S. Economic Calendar.

While the PPI was up 0.7%, which was expected as higher energy costs impacted producers. Absent energy costs, the PPI was just up 0.2%.

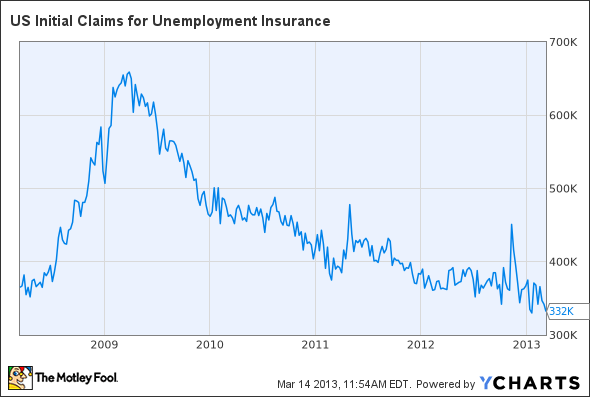

The one to pay attention is the unemployment claims report. Weekly new unemployment claims fell to a seasonally adjusted 332,000. That's down from last week's 342,000 and below analyst expectations of 350,000. Last year, new unemployment claims averaged between 360,000 and 370,000 and never really broke out of that range. The declining level of new unemployment claims is a good sign for the economy, indicating that the jobs market is strengthening. It remains to be seen whether this is a trend or just a blip.

US Initial Claims for Unemployment Insurance data by YCharts.

New unemployment claims can be volatile, so it is generally better to watch the four-week moving average, which dropped by 2,750 to 346,750. That's the lowest level since 2008.

While the jobs market is strengthening, the economy is still not adding jobs fast enough to significantly reduce the unemployment rate anytime soon. The Federal Reserve Open Market Committee has said it plans to continue QE3 until the unemployment rate hits 6.5% or inflation picks up. Until then, the Fed will continue buying up $85 billion worth of long-term assets every month to prop up the economy.

Today's Dow leaders

Today's Dow leader is Hewlett-Packard , up 1.8% to $21.71 on no real news. Earlier this week the British Serious Fraud Office opened an investigation into HP's accusations of fraud against former executives of Autonomy. If you recall, HP acquired Autonomy for $10 billion in 2011, only to write the acquisition down for $8.8 billion last year. HP accused former executives -- including Autonomy's founder and former CEO, Mike Lynch -- of fabricating sales to boost Autonomy's financials. While American authorities commenced investigations soon after HP's accusations, this is the first notice that British authorities are also investigating.

While the stock was hit hard last year, dropping 47% in 2012, there have been no repercussions for the board members who approved the deal. Institutional proxy advisor Institutional Shareholder Services is recommending that investors vote against HP chairman Ray Lane, audit committee head G. Kennedy Thompson, and finance and investments committee head John Hammergren.

HP is rapidly shifting its strategy under the new leadership of CEO Meg Whitman, and this shift should include new board management, as the current leadership has been a disaster for shareholders.

The question remains for investors: Is HP one of the least appreciated turnaround stories on the market, or is this a minor detour on its road to irrelevance? The Motley Fool's technology analyst details exactly what investors need to know about HP in our new premium research report. Just click here now to get your copy today.

The article Hewlett-Packard Leads the Dow to New Highs originally appeared on Fool.com.

Dan Dzombak can be found on Twitter @DanDzombak or on his Facebook page, DanDzombak. He has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.