My Top 2 Stocks: Berkshire Hathaway and Waste Management

I haven't been in the investing "game" for that long, but my two largest holdings are among the first shares that I purchased when I started getting serious about investing. One is a behemoth with revenue streams among multiple industries, while the other leads the way in its very important industry. It is easy to see why they're leading the way in my modest portfolio.

Barring any major surprises, Berkshire Hathaway and Waste Management should maintain the top two spots in my portfolio for the near future and are on my short list for receiving more of my investing funds in the next couple of months. Though the reasons I chose the companies were different, I have been pleased with my decision thus far and hope for continued great performance from both companies.

Why Berkshire Hathaway?

When I became serious about investing early last year, I was looking for a strong foundation to start out my small portfolio on the right foot. I was looking for a company that had a long track record of market-beating performance, but also one that I thought would continue to do so for the foreseeable future. As a fan of value investing, particularly Benjamin Graham, I figured a great place to start would be with the company run by Warren Buffett, perhaps Graham's most famous student and one of the world's best investors.

Berkshire Hathaway is a unique company, and investors in it get rewarded in a multitude of ways. One way is to reap the benefits of its multitude of wholly owned subsidiaries across a variety of industries. Berkshire is perhaps best known for its insurance operations, led by GEICO, but the non-insurance companies it owns also add a lot of money to the Berkshire coffers. Last year, Berkshire's five most profitable non-insurance companies -- including the BNSF railroad and Mid-American Energy -- earned more than $10 billion for Berkshire and its shareholders last year. Quite an impressive number.

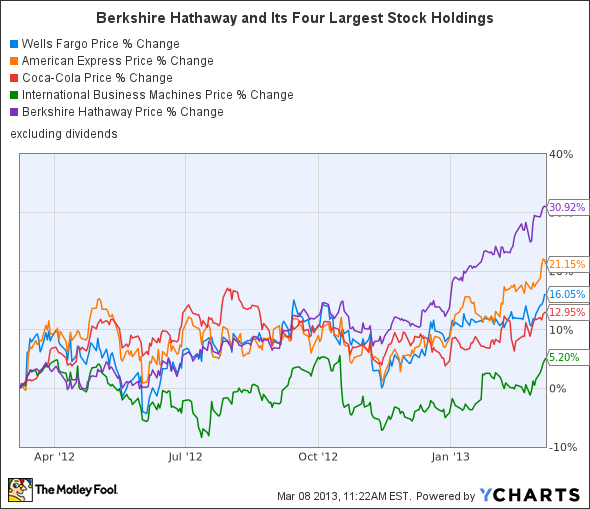

Investing in Berkshire Hathaway also allows you to share in the performance of the company's stock portfolio, which is full of stock picks from not only Warren Buffett and Charlie Munger, but also Todd Combs and Ted Weschler, two men Buffett picked to manage an ever-growing portion of Berkshire's investment funds. Berkshire's four largest holdings all saw gains during the past year, helping to boost the performance of Berkshire as a whole:

Berkshire Hathaway is a company that I'm comfortable owning for a very long time and one that I don't really worry about. Despite its recent run to new heights, I'll be adding more to my holding over the next few months to truly benefit from one of the greatest companies out there.

Why Waste Management?

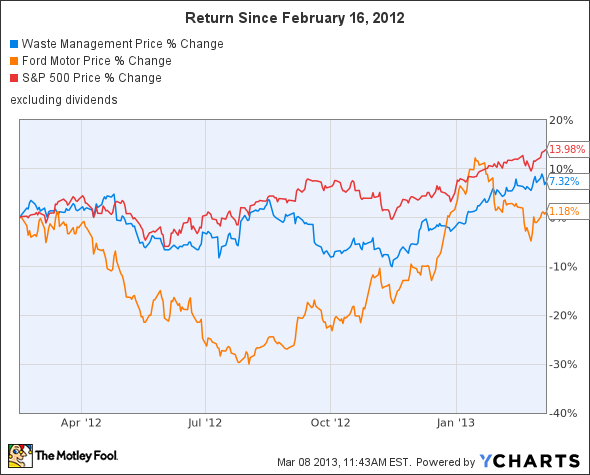

I added Waste Management to my portfolio when I was looking for a strong and sustainable dividend to add some income of my portfolio. When I added Waste Management and Ford to my portfolio, I did so in equal amounts. While neither has beaten the market, Waste Management has performed much better than Ford since I added them to my portfolio, and it's easy to see why it's secure in its second-place position:

Waste Management truly is the leader in the American trash-hauling business. Not only are its ubiquitous green trucks everywhere hauling the trash, but it also owns or operates 269 landfills, the largest network in its industry. Its next largest competitor, Republic Services , isn't too far behind, with 191 solid-waste landfills.

The ownership of so many landfills makes it difficult for Waste Management customers to switch its trash service. While any municipality can decide to haul its own trash, it could be exceedingly difficult for them to start their own landfills. That gives Waste Management a moat of sorts in its industry, protecting it from a lot of direct impact to its primary business. Finally, because construction tends to generate a lot of trash, Waste Management is poised to continue doing well, especially as commercial and residential construction continues to improve over the coming year.

Beyond its business, however, one of the reasons I'm glad to own shares of the company is its dedication to dividends. It recently boosted its dividend for the 10th year in a row, resulting in a yield near 4%. Because of this dividend, as well as its position as leader in its industry, I also plan on adding to my holding to Waste Management, firmly entrenching it as the second largest holding in my portfolio.

Two industry leaders

You can't go wrong with investing in companies that lead their respective industries, which is something my top two holdings reflect. Berkshire Hathaway is a leader in the insurance business but also is one of the best allocators of capital in the market today. Waste Management, on the other hand, leads the U.S. waste industry, both in regard to hauling trash and disposing of it. Hopefully, these companies will continue to drive the performance of my portfolio for many years.

While Berkshire Hathaway and Waste Management are my top two stock holdings, our co-founder, Tom Gardner, recently revealed his top two stocks as well. For the names of that surprising pair of companies, just click here.

Waste Management has been a longtime favorite for dividend seekers everywhere, but the share-price performance over the last few years has left many investors wanting. If you're wondering whether this dividend dynamo is a buy today, you should read our premium analyst report on the company today. Just click here now for access.

The article My Top 2 Stocks: Berkshire Hathaway and Waste Management originally appeared on Fool.com.

Fool contributor Robert Eberhard owns shares of Berkshire Hathaway, Waste Management, and Ford. The Motley Fool recommends American Express, Berkshire Hathaway, Coca-Cola, Ford, Republic Services, Waste Management, and Wells Fargo and owns shares of Berkshire Hathaway, Ford, IBM, Waste Management, and Wells Fargo. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.